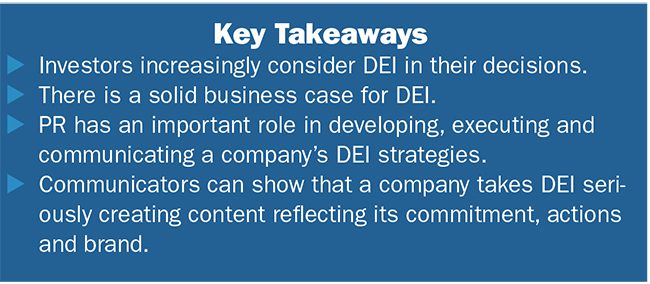

Just a few years ago, leaders of many companies thought ESG (Environmental, Social and Governance) was a passing trend. They were wrong.

Not only is ESG here to stay, despite some bumps; it continues to gain traction.

Since 2016, investment in financial products that claim they adhere to ESG rules has grown, from $23trn to $35trn, The Economist reports. Bloomberg Intelligence believes this figure could reach $50trn in 2025.

Investors Pay Attention

For investors, this means viewing ESG as important criteria. It can be a differentiating factor in selecting one company over another and supporting board members.

Consider:

- Reuters reports “investors concerned about climate change and social justice had a bumper year in 2021, successfully pushing companies and regulators to make changes amid record inflows to funds focused on ESG issues.”

- The world’s leading proponent of responsible investment, PRI reported 97% of its approximately 4,800 asset and investment owner signatories incorporated ESG factors into their equity investments in 2020.

The environmental and social components of ESG have attracted the interest of the U.S. Securities and Exchange Commission (SEC) and other regulators. In the highly visible area of DEI, the SEC and Nasdaq have acted, mandating significant new requirements for companies.

New DEI Disclosure Requirements

In August 2021, the SEC approved Nasdaq listing rules on gender diversity. They require that all companies listed on Nasdaq’s U.S. exchange disclose their boards' diversity statistics.

Listed companies must have, or explain why they do not, at least two diverse directors. The requirements phase in next year.

The Business Case for DEI

There is a growing amount of data showing the correlation between DEI and financial performance. In its widely reported 2020 study on diversity, McKinsey & Company found that companies with the highest levels of gender diversity on executive teams were more likely to have above-average profitability, as opposed to male-dominated firms.

In addition, the most ethnically and culturally diverse companies were 36% more likely to post larger profits than their less-diverse peers.

While not yet an SEC requirement, diversity and inclusion disclosures are important topics at large public companies. 80% of the S&P 500 discussed their work to achieve equitable businesses in their 2021 annual reports, according to Bloomberg Law.

Moving the Needle

While progress is occurring, much work is ahead. Women held 27% of all board seats in 2021, reflecting the largest ever year-over-year increase in what leadership groups Women Business Collaborative and 50/50 Women on Boards call a “watershed” achievement.

Efforts to track the number of women on boards has grown with the increasing focus on these initiatives.

However, some organizations have been trailblazers in working to achieve a balanced representation of women on boards of directors. One, Milwaukee Women inc, has provided research on the number of women on Wisconsin’s top 50 public companies' boards for nearly 20 years. [Editor's Note: Milwaukee Women inc. has a relationship with the author's company.]

Communication's Critical Role

As we know, a successful DEI effort starts at the top, with the board and executive leadership. When developing an organization’s DEI strategy and plan, core business functions must be at the table.

While audiences have different needs, a company's DEI messaging must be consistent across all stakeholders for maximum effectiveness and engagement.

That’s where communication is needed. Communicators have a tremendous opportunity–and challenge–in shaping an organization’s DEI effort. In addition, they must implement internal and external communication that tell the company’s DEI story.

Tactics

For companies looking to augment their DEI strategies, below is a short list of critical elements from a communication perspective:

- Authenticity: When a company believes deeply in DEI and builds a culture reflecting it, stakeholders will notice. DEI will resonate in the company's work, workforce, products and messaging. On the other hand, the last thing you want is a disconnect between what you say on DEI and what you do. This can create uncertainty and distrust.

- DEI Statement: As such, create a DEI statement consistent with the company’s mission and values. Similarly, it should define the company’s commitment, aspirational goals, accountability and measurement. Develop key messages that help explain the DEI statement across all audiences.

- Distribution: Distribute the statement widely across the company. At a minimum, place the statement on your website. Even better, add a special DEI section on the site. Make sure it goes beyond the DEI statement. It should include goals, initiatives, metrics and success stories. Include the DEI statement in your annual report and other external and internal communication. Discuss goals and strategies and report on results.

- Strategy: Create a DEI strategy and plan that touches all stakeholders: employees, investors, customers, suppliers and communities. Develop specific initiatives for each audience.

- Measure: Set DEI goals that are measurable. Begin with a benchmarking exercise that illustrates where you are at present. After that, document progress. Items to consider:

- Percentage of diverse employees across the organization and in leadership

- Number of diverse employees in the promotion pipeline and applicant pool

- Percentage of employees hired and promoted

- Diverse employee retention rate

- Participation in DEI training and/or employee diversity resource groups (ESGs)

- Use engagement surveys to gauge how employees feel about company culture, job satisfaction, work environment and comfort level in providing feedback and ideas to managers and leaders.

- Mindfulness: Remember that not everyone will view DEI initiatives the same way. Employees who have concerns or are resistant will need encouragement, understanding and additional education.

- Journey: Remember, executing DEI strategies is a marathon, not a sprint. Changing company culture and employees’ beliefs take time.

- Communicate: Show commitment and engage employees through action, messaging and results. If you aren’t there (and few, if any, companies are at this point), don’t stay quiet. With a crescendo in DEI interest after the unrest of 2020, stakeholders expect to see how you are approaching this important issue.

Communicators' Role

Here are ways communicators can help bolster DEI activities:

- Communicate DEI's value. Create assets that discuss how DEI benefits the company and its employees. Message how internal and external audiences benefit from diverse perspectives and experiences and the culture change these can help foster.

- Tell stories. Create narratives around strategy, activities and progress toward stated goals. Highlight individuals, programs and partnerships internally and in the community. Plans are important, but execution matters much more.

- Transparency. Highlighting successes builds confidence and support among stakeholders. Yet acknowledge where the company is and wants to go. Admit where work is needed and how things can improve.

- Consider visuals. Do you show diversity in race, age, disability and other criteria?

- Create internal guidelines. These will include key messages and examples of inclusive language. Review existing content for inclusive language.

- Maintain two-way communication. A key role of the communication team is giving feedback to top leaders about how DEI communication is received and if it is impactful. Surveys, anecdotal comments and employee questions can show if messages are getting through. Highlight areas that need attention and assess support for the initiative.