Barack Obama’s 2008 presidential campaign was remarkable for its simple, consistent messaging that revolved primarily around two words, “hope” and “change.” In 2012, however, the Obama reelection effort has multiple messages, many of them in response to Republican criticism of his effectiveness in his first term in office.

In effect, Obama has had to rebrand himself, not unlike corporate brands whose situations may change for any number of reasons, including lack of relevancy; a crisis that causes negative public perception of the brand; and business growth—or lack thereof.

Currently, the fast food industry and beverage companies are under pressure—from an increasingly concerned public as well as government regulators—to address the obesity problem in the U.S. To say companies like PepsiCo and Coca-Cola are embarking on wholesale rebranding because of it is a stretch, but no doubt they are reexamining their messaging by conducting research on customers’ perceptions of sugary drinks ( PR News contacted both companies to get more details, but neither responded to our requests).

“People who have already bought into a brand like Coke are willing to allow some leeway for the brand to change or grow,” says Mike Herman, CEO at Communication Sciences International. This might not be the case with clothing retailer J.C. Penney, which in the past few months has been attempting to move from a sale-oriented price model to an “everyday low price” model—with little success so far in terms of an increase in business.

Achieving success with a rebrand or a major change in message begins with research: learning what your audiences want (and don’t want) and how they might have changed are key to any organization looking to move the business needle. So PR News asked brand research experts for tips on figuring out how to make a major brand change should it become necessary—a rebrand primer if you will.

First, before research can begin in earnest, you must ask yourself questions involving a potential rebrand, says Pauline Draper-Watts, executive VP of research and measurement agency StrategyOne. The most important question: Why rebrand? Then, ask the following series of questions:

• What are you known for now?

• What are you trying to become?

• What are you looking to take with you?

• What are you looking to leave behind?

• How will you live up to your new brand?

QUALITATIVE RESEARCH

Not unexpectedly, the key to answering those questions starts with your target audience, says Adam Burns, senior VP, strategic planning and research at Porter Novelli. “Listen to what the target audience needs and use that information to help inform the brand,” says Burns. This means actually listening to them—not trying to convince them that your new approach is better, adds Burns.

And the more details you can get initially from your audience, the better a rebrand will be, says Burns. This is where qualitative research comes in. “It’s learning about the context with which people interact with your brand,” he says. “If you don’t get this context up front, you won’t understand how your customers interact with your brand in their everyday lives.”

Qualitative research usually takes the form of focus groups and one-on-one interviews. It’s in this step that you’ll collect a multitude of propositional attributes and benefits about your brand, all presenting branding opportunities, says Deborah Radman, director of marketing at PRIME Research. “Once this list is developed, decide on which possibilities are most likely to succeed, and test them through quantitative research,” says Radman. That means a survey to a sample of 300 to 1,000 respondents.

QUANTITATIVE AND MORE

|

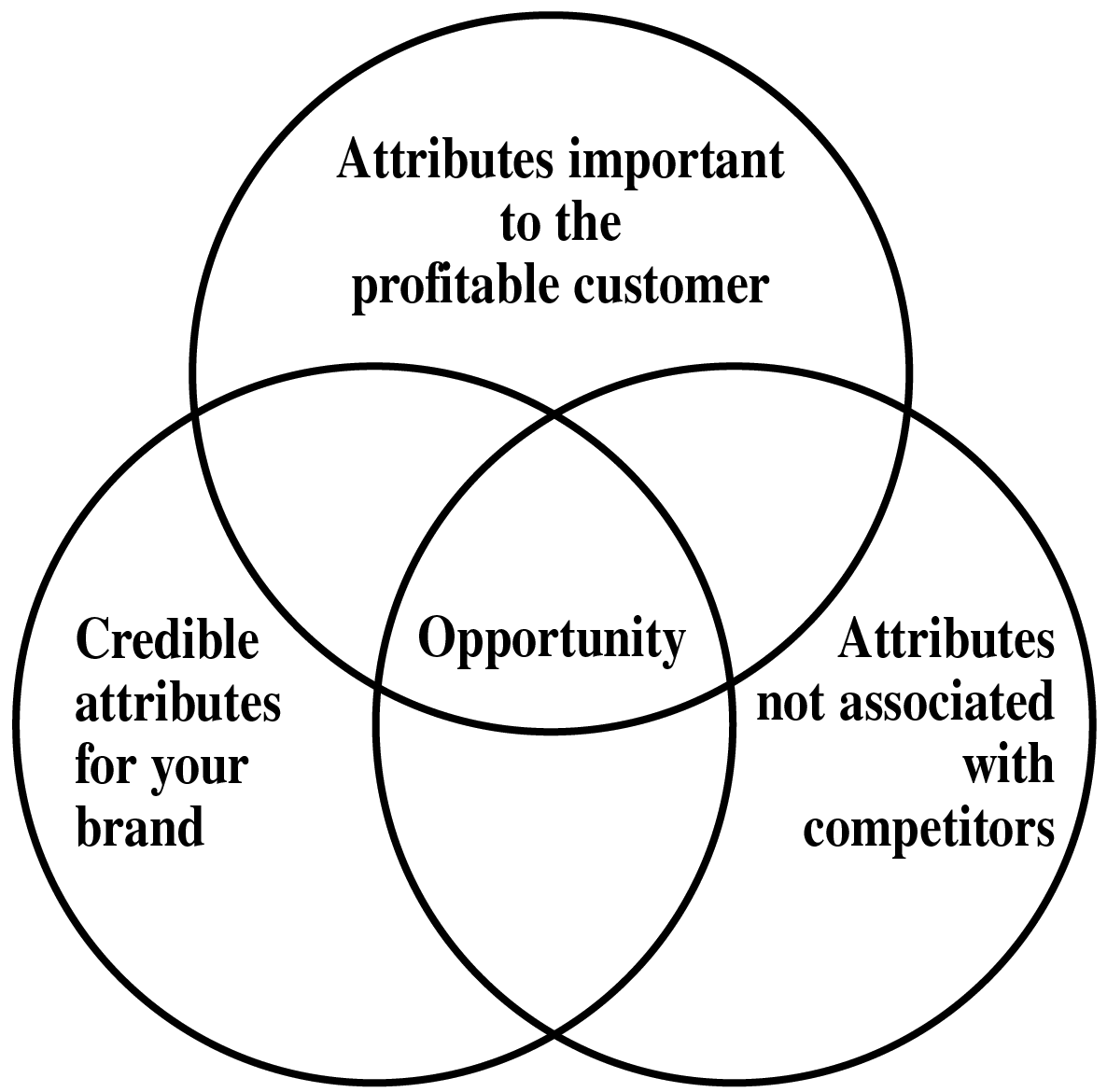

| Discovering attributes in these important areas can help lead to a successful rebrand. Graphic Courtesy of PRIME Research |

Then, says Radman, a formal analysis designed to explore the three or four major drivers revealed in the quantitative study should ensue, to uncover nuances and intensity of the audience’s needs, and to get a clear picture of the competitive environment.

There are other research components to consider. Big brands have the resources to follow employees and customers around (known as ethnographics); then there’s research most brands can do—traditional and social media analysis.

“The purpose of this analysis is to determine the extent to which the three or four winning brand attributes are delivered via conversations and the media by your company and your competitors,” says Radman. Smart brand planners give the highest priority to those attributes that are important to the audience.

FOLLOW THROUGH

Draper-Watts says comprehensive rebrand research does yield good results, but it’s what an organization does with that data that is critical, and often brands don’t do enough. “The amount of money left on the table due to failing to optimize these brand actions is usually staggering,” she says.

Then there are instances in which organizations try to stay the brand course, regardless of what research might find. J.C. Penney’s CEO Ron Johnson seems determined to move forward with his “everyday low price” strategy, despite a steady decrease in business and external studies that show consumers prefer sales and coupons.

It’s possible that a strong brand, says Herman, can win customers over with such a strategy. Time will tell whether J.C. Penny is such a brand. PRN

CONTACT:

Mike Herman, [email protected]; Adam Burns, [email protected]; Deborah Radman, [email protected]; Pauline Draper-Watts, [email protected].

Follow Scott Van Camp: @svancamp01