What a Difference One Year Makes: Almost exactly 12 months ago we asked Oscar Suris, EVP and chief of executive communications at Wells Fargo, to discuss internal communications at what then was the country’s largest bank by value ( PRN, Oct. 12, 2015). The occasion was the release of an Institute for Public Relations (IPR) study of internal communications. The chairman of IPR’s board of trustees, Suris described a culture where the bank’s 265,000 employees demanded to be fully informed of developments, both good and bad. Suris had strong praise for the bank’s CEO John Stumpf, whom he described as a straight shooter who valued authenticity and hard truths. “When employees hear from leaders, they want frank talk and accessibility,” Suris wrote in our pages. “They also welcome an emotional connection. At Wells Fargo, we’re blessed with a CEO who’s a superb extemporaneous speaker and appreciates authentic dialogue. Following his lead, we aim for plain language over jargon, which frees us to acknowledge hard truths and empowers others to speak from the heart, whenever appropriate.” Suris continued, noting “Mr. Stumpf’s most popular internal communications routine is his quarterly CEO town hall, broadcast via satellite and webcast to team members globally. He reviews financial performance, puts business issues and news into perspective and tackles tough topics during a live Q&A.” Suris noted that Stumpf was so good off the cuff that “he requests not to see team members’ questions in advance. Team members know they will hear directly from their CEO in his voice during these regular fireside chats.” Is this the same John Stumpf who initially refused to acknowledge “the hard truths” of the phony accounts scandal that eventually led to his resignation Oct. 12? The same CEO who failed to lead in so many ways, but mainly by failing to move swiftly to investigate how an estimated 2 million bogus products were created on his watch? The CEO who, in his first interviews after the scandal broke early last month, seemed to place blame on lower-level employees? We like Oscar Suris; through much of the scandal he’s returned our calls, setting an example for communicators. We’ll accept his praise of the now-former CEO at face value. As such we assume Stumpf either was poorly advised regarding how to handle the scandal, froze up due to the pressure or genuinely believed he was being authentic. That means, initially at least, Stumpf thought Wells Fargo’s culture remained healthy, despite the fact that 5,300 employees used customers’ identities to open bogus accounts. Indeed, a point of pride for Stumpf had been the bank’s culture and its employees, which he credited often for Wells Fargo’s success. As we know, lawmakers on both sides of the aisle didn’t warm to Stumpf’s authenticity ( PRN, Oct 3). While he eventually was more contrite during his second Capitol Hill appearance Sept. 29, announcing that he was forfeiting $41 million in unvested equity and agreeing to go without salary during a board-launched investigation of the scandal, Stumpf continued to deny “an orchestrated effort” was responsible for thousands of employees committing fraud. We anxiously await the findings of the investigation and how they will treat Stumpf and other members of his executive team. The investigation is expected to wrap in December or early 2017. Pending the investigation’s findings, the board could ask Stumpf to return additional pay to the bank.

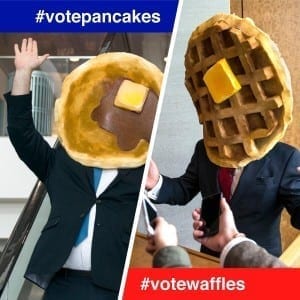

News Bits: Mylan agreed to pay $465 million to resolve issues concerning classification of its EpiPen, the company said Oct. 12. The Centers for Medicaid and Medicare Services found Mylan had misclassified EpiPen as a generic drug. As a result Mylan has been underpaying rebates. In a statement, the pharma brand refused to acknowledge wrongdoing. Shares rose nearly 10% to $38 on word of the settlement, far from the mid-$50 price Mylan commanded prior to the EpiPen scandal ( PRN, Sept. 26). – D.C.-based McBee Strategic Consulting rebranded as Signal Group. -- Another brand waffled when it should have been listening to the social media conversation, and its tone-deaf attempt at levity was as flat as a pancake. As Hillary Clinton and Donald Trump squared off Oct. 9 in their 2nd debate, some 17 million politics-related tweets flew by, a tempting target for brands, but a minefield, too. As the Trump video and Syria were discussed, Bisquick tweeted a presidential-debate-style #pancakesvswaffles contest. A typical retort came from @North_Northwest: “Dear @Bisquick. Sit this one out. I get it. The debate’s a promo opportunity. But not today. Get off my twitter feed.”

People: Wrigley SVP Andy Pharoah was named to lead communications at parent Mars. He replaces David Kamenetzky, who left to start an investment firm. Pharoah reports to CEO Grant Reid. – Lippe Taylor named former Grey exec Fred Gerantabee chief digital officer. – Gould+Partners named Sally Tilleray senior advisor, U.K.