We’ll paraphrase what we wrote on page 8, column 3, “Whom do you trust?” As we’ve seen in the Edelman Trust Barometer 2018, the answer on a global scale is: very few institutions. This lack of trust includes brands and their leaders, as well as political parties and their chiefs (PRN, January 30, 2018).

In terms of corporate reputation, which is closely aligned with trust, the gold standard is the annual Global RepTrak 100, a report from The Reputation Institute. Its 2018 edition was released last week.

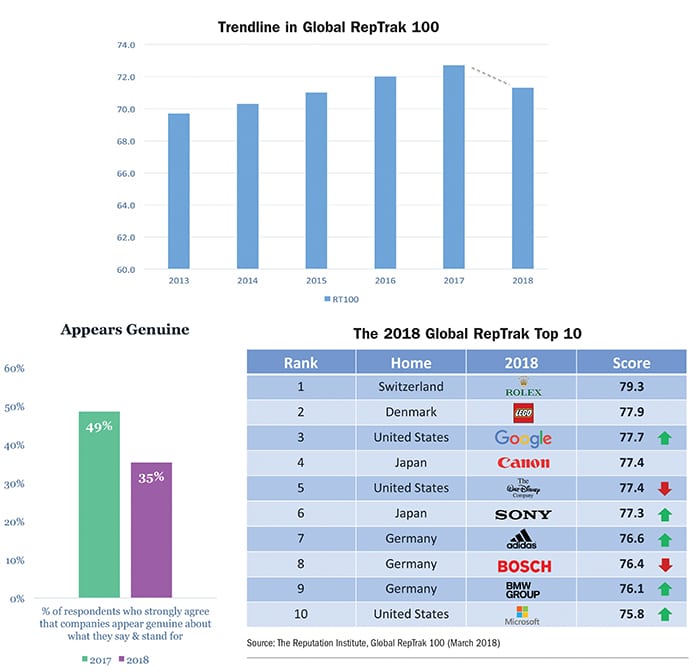

In short, the report agrees with much of what Edelman says about the global climate influencing companies’ reputations. As you can see from the chart at the top of the next page, the RepTrak score for companies fell in the 2018 report. The decline, marking a strategic inflection point, was the first downturn since the end of the Great Recession in 2009.

No Escaping Reputation Woes

Exec Partner/Chief of Research, The Reputation Institute

Even the top 10 most-reputable companies for 2018, listed in the chart below, has a blemish. The top company, Rolex, with a RepTrak score of 79.3, is considered very good but not excellent.

The industries hit hardest in the average rankings included Hospitality (-16), Transportation (-13) and Airlines (-12).

Fortunately for communicators, the way to begin to re-build corporate reputation, the report says, is related directly to communications. More about that below.

7 Factors of Reputation

The Reputation Institute bases a company’s reputation rating, or RepTrak score, on seven factors: products/services, innovation, workplace, governance, citizenship, leadership and performance. The report measures 100 multinational companies in 15 countries.

What the bursting of the reputational bubble means in practical terms, according to the report, is that it will be more difficult for companies to: recruit the best talent (-6.1%); garner investment (-8.1%); and retain loyal customers. The lack of trust will result in a 7.9% decline in loyalty toward purchasing a company’s products.

Another result of the trust decline that is relevant to communicators, particularly during a crisis: just 38.5% of the public trust companies to do the right thing. “The jury is out for most companies, because they’re less likely to be trusted,” the report concludes. Companies are less likely to do the right thing when nobody is looking, the report says.

As mentioned above, the flip side to the downturn in reputation, though, is that “companies that can find the right balance of authentic and genuine persona can reach significant reputation gains,” says Stephen Hahn-Griffiths, Reputation Institute’s chief research officer/executive partner. He tells us the top 10 companies saw a 4.1-point increase in reputation “just through the merits of knowing how to have an honest and genuine dialogue and a real, authentic line or channel of communication.”

Another upside for companies is that about half the world (51%) remains on the fence: this group is open to being convinced that companies can be trusted, as shown in the chart that opens this story.

Of relevance for communicators, as the table below, left illustrates, this year’s report showed a one-year decline (49% to 35%) in the perception that a given company will be seen as communicating in a genuine and authentic manner. “This basically says the majority of companies are speaking in an inauthentic way,” Hahn-Griffiths says. “Perhaps there’s too much hyperbole in the corporative narrative…the underlying lack of trust or disbelief is possibly lack of relevancy in some of the topics being discussed.”

Hahn-Griffith also argues the speaker for companies wishing to improve its reputation should be its CEO. He predicts an increased trend in the importance of the CEO and his/her “ability to impact the reputation of the firm.” The CEO, though, must talk with “a sense of conscience, not just a sense of fiscal responsibility,” he says.

Does it have to be the CEO making the pitch? It could be another high-ranking officer, Hahn-Griffiths admits, but it should be the CEO. Having the CEO speak for the company, he says, “creates credibility…if your brand uses a spokesman instead you run the risk of that person being perceived as not representing the whole company.”

The Human CEO

Hahn-Griffiths adds that part of a company being perceived as genuine “is unleashing the human side of your CEO and having him or her up there with the conversational outlines for the brand narrative that’s perhaps connected to the best interests of social responsibility, the best interests of the welfare of mankind and maybe aligns with sustainability and environmental issues.”

The CEO must find a way to convey “a sense of empathy.” Beyond general familiarity, companies need to create depth of understanding of what they stand for, he says. Increasingly this will become a competitive differentiator, Hahn-Griffiths says.

Another of the keys, he adds, is the CEO needs to talk about “what matters to people...what’s important to them, the community they live in…so CEOs who can align themselves with human interest stories are the ones who’re going to drive success for their companies.”

Where did the downturn in reputation come from? “We align it with an erosion of trust,” he says. “Trust in the integrity of companies and in what they are doing to make the world a better place.” There’s also a lack of trust in politics.

Fake news, tweet ranting, political and economic unrest and unsettling events such as the recent school shooting in S. Florida are drivers behind the decline in trust. The result is people now “look at companies with new eyes…companies are trapped because people aren’t even sure they trust their governments, political parties and the media.

CONTACT: [email protected]