It’s been a long, hot summer for two of America’s most well-known institutions, GE and the United Auto Workers (UAW). Harry Markopolos, a researcher known for revealing the Bernie Madoff Ponzi scheme, accused GE of an Enron-like fraud.

The UAW faces federal scrutiny amid damning revelations of fraud and corruption. GE managed a very quick recovery. It seems to face a less-tarnished future than the UAW. Not surprisingly, the reason behind the two different futures is communications.

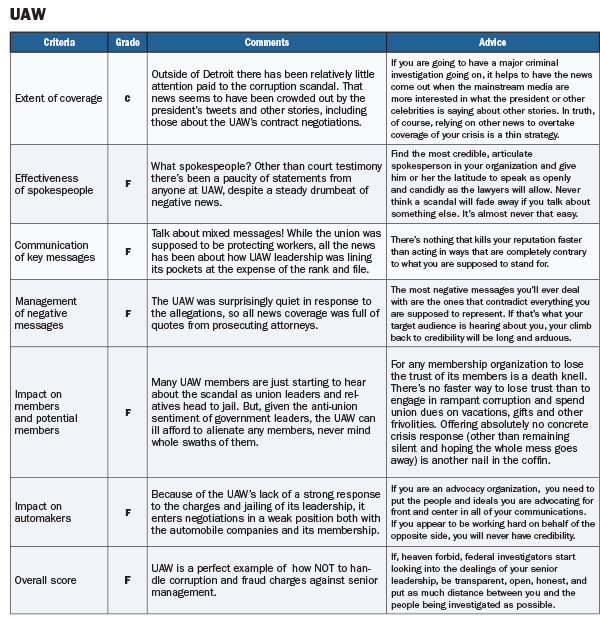

The UAW

The UAW scandal began in 2017 with a tax fraud investigation of Fiat Chrysler and UAW leadership.

Investigators discovered that some UAW leaders had bought more than $40,000 in clothing, jewelry and other personal items using a credit card for a Chrysler training center. At the time, the UAW’s response was that this was an isolated local problem. Then, in January 2018, a former Chrysler Group VP pled guilty to his part in what turned out to be a $4.5 million corruption scandal to win favorable treatment from the UAW for Fiat Chrysler.

In July 2019 UAW officials began to be charged, starting with a former aid to a UAW VP who agreed to a plea deal. Not long after, former UAW VP Norwood Jewell was sentenced to 15 months in prison for accepting more than $40,000 worth of travel and meals from Ford/Chrysler.

Years of Crisis, Little Response

In the past year the charges of corruption have continued to accumulate – including schemes to create shell companies to buy watches and other tchotchkes that UAW sold and gave away at events. Charges now include wire fraud conspiracy and money laundering. Several senior UAW officials are charged with pocketing millions in kickbacks and bribes from UAW contractors. Nine people have been convicted so far.

Rather than do what most organizations under major scandal clouds might do – appoint an independent investigator, fire or suspend all those suspected of violating rules, hire a forensic accountant, adopt a new code of conduct to prevent future misdeeds – the UAW has done almost nothing.

At the moment, UAW leadership’s focus has been on contract negotiations with the big three Detroit auto companies (Ford, GM and Fiat Chrysler). Those talks began last month. UAW members’ contracts with the automakers expire Sept. 14.

Leading the Talks

As if the negotiations weren’t tense enough given potential debate over job security, wages, health care, benefits and vehicle products, the FBI and IRS raided the homes of UAW president Gary Jones (and his predecessor) Aug. 28. Other UAW-related properties were raided that day too.

Talks with the big 3 are proceeding. UAW says it’s not changing negotiating strategy despite recent events. UAW’s rank and file, however, seem understandably suspicious of the motivations of Jones, who oversees the talks, and his team. Will UAW members trust anything leadership says?

As of late last week, Jones had not been charged with a crime. The UAW insists there was no need for the raids on its leader’s home because officials have “been cooperating” with the government’s investigation.

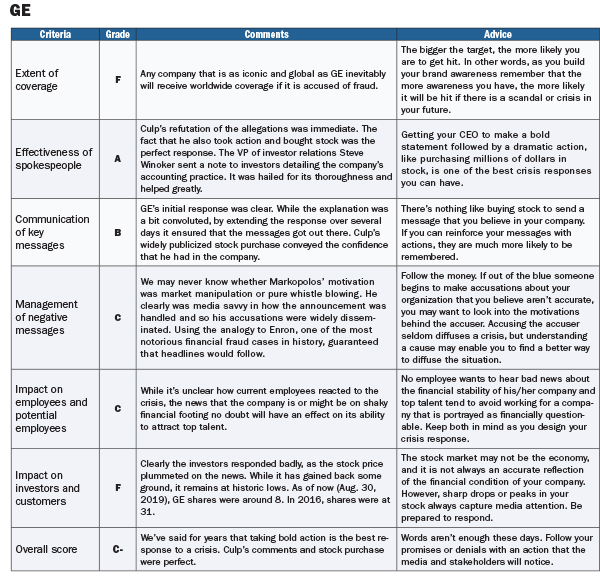

General Electric Company

GE has had a rough few years. The Thomas Edison-founded company was long seen as one of America’s largest and strongest brands. Legendary CEO Jack Welch led the company’s strong growth for 20 years and was one of the most admired leaders in America. Since his retirement in 2001, the company has had three CEOs, with one surviving just 12 months.

If the past few years were rocky, last month was even worse. GE’s share price hit an all-time low when the fraud accusations surfaced, in early August.

Current CEO Lawrence Culp is the first GE chief hired from outside the company. On the job fewer than 12 months, his response to the fraud charges was forceful and clear. He immediately invested $2 million of his money in GE stock. While that may not have made much of a dent in his assets, it sent a bold and reassuring message to investors.

Culp also suggested that Markopolos, the accuser, was “working with hedge funds that are financially motivated to generate short-selling in a company’s stock to create unnecessary volatility.”

Also included in GE’s response were supportive comments from independent board members, including the head of the audit committee, who assured media that GE was cooperating fully with the SEC. The end result was that most of the news coverage of the fraud dwindled within a week.

CONTACT: kdpaine@painepublishing.com