Crisis pros know it’s important to have the right tools in their arsenal. A platform that can monitor traditional and social media is one of them. Having such data before, during and after a crisis can be invaluable to crisis pros.

Do Your Homework, speed kills

What came first—the chicken or the egg? If you’re asking, what came first—the data or a crisis—better put your eggs in the data basket. If you are waiting for a crisis before choosing a measurement platform, you are already too late.

On the other hand, it’s best not to rush into purchasing a tool, several measurement experts say. There’s much to consider before investing.

For example, one thing to consider is how long it will take to get a tool set up.

“Tools are marketed as you can flip a switch [and you’re ready to go]. It’s just not true,” says Mark Weiner, chief insights officer at Cognito.

“Tools,” he says, “require a lot of teaching—for the computer and operator. The computer can only do what it’s taught to do; it doesn’t think.”

“When you say ‘crisis,’ it can be defined in a thousand ways, and all those words have to be entered” into the measurement platform, Weiner says. “It can be very specific to that company, and the computer has to be trained...The person who operates the tool also has to be trained to extract the data once it’s generated.”

These tasks can include entering and analyzing hundreds of keywords related to possible crises.

In a recent article in PRNEWS, Weiner examines why companies don’t always use their shiny new platforms.

Sometimes the technology is too heavy-handed for users. In other situations, the decision-makers who purchased the tools miscalculated the needs for setup and implementation.

Weiner advises organizations consider several things before investing in a platform.

“[Companies should] ask: What do we want to achieve with this technology? Who is using the technology in the organization, and to what end?”

Involving the person(s) in the buying process who’ll be operating the tool is critical. That should help ensure they will embrace the tool with enthusiasm.

If a tool is thrust on a user, without his or her input on the choice, the company’s investment may be wasted as the tool sits largely unused.

How Many Tools?

In reality, crisis pros usually aren’t seeking one tool. For instance, Johna Burke, global managing director for the Association for the Measurement and Evaluation of Communication (AMEC), suggests considering several tools.

While vendors sometimes tout their tools as being one-stop shops, a given platform may lack several capabilities a crisis pro needs.

Instead, one might need several tools for listening (social and earned media), audience and sentiment, visualization.

Cindy Villafranca, a manager of insight, analytics, communications and outreach at Southwest Airlines, urges tool buyers to carefully consider their choices.

“Be sure you know what you need to support your business,” she says. “Know what data and insights will tell the best story for your internal stakeholders and help them make informed decisions.”

Measurement guru Katie Paine of Paine Publishing provides a helpful list of data needs and measurement vendor matches.

Buyer beware, though. Paine notes few sites hawking tools “offer useful information. Most are full of buzzwords...with very few specifics. Almost none of them offer any useful pricing data.” So, prospective buyers may need to go through “the agonizing process of requesting a demo and hearing the sales pitches.”

Measurement in Action

At Southwest, measurement tools are used before, during and after a crisis, Villafranca says. Its teams employ Sprinklr to monitor social conversations, and Cision for media dialogues.

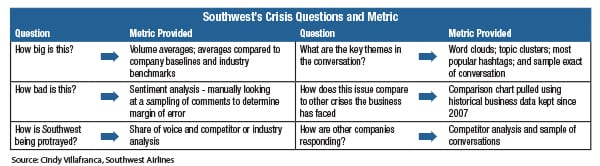

“In a crisis or hot issue, our measurement strategy starts with questions and ends with metrics,” she says.

The team asks:

- What’s the issue?

- Does it warrant a response?

- What is the company’s response/stance?

- What is the risk if we don’t respond?

“When we see mentions about our company spike, positive or negative, we identify what is happening and what we need to do in response.”

After that, staff creates data-driven insights based on questions in the table below to give to company leaders.

Monitoring continues beyond the crisis, centering on reputation, she says. Southwest uses RepTrak data to monitor its reputation after a crisis.

Nicole Schuman is Senior Editor of PRNEWS.