During the past few years it’s become a tradition for PRNEWS to join PublicRelay, a media monitoring and analytics firm, in celebrating Measurement Month. The celebration begins with a survey about the state of measurement.

In introducing last year’s survey results, we postulated that communications’ measurement woes were behind it. It seemed that a growing tide of communicators solidly supported the idea that it’s important to use data as part of their job (PRN, Nov. 2018).

“We definitely feel a wind at our back” in favor of collecting, measuring and analyzing data, is how PublicRelay’s president/CEO Eric Koefoot put it during a 2018 interview.

This makes sense in a digital environment, where nearly everything a communicator does is measureable. In addition, more and more C-suites are demanding data en route to making decisions in all facets of business, not just in communications.

The push for measurement in communications also may be tied to the realization that data has become “a competitive weapon,” Koefoot says. “It’s not the only thing” executives use to make decisions, “especially in communications,” but it’s an important point of reference, he adds.

These factors have combined to make business a data-rich endeavor. As Matt Anchin, CCO at Consumer Reports, told us last year, “The existential threat where marketers were” about a decade ago “is where the leaders of our profession are…now. The decisions you make and the strategies you design, the results you deliver, if they’re not data-driven, especially in a world where so much data is readily available, you’re not going to be in a good spot.”

More than merely measuring to prove ROI, the 2018 survey showed a rise in the number of communicators seeking insights from data.

As Kevin Winston, principal communications business partner at Genentech/Roche, told us in 2018, “There’s no question. The tide is changing” in favor of using data to garner insights. “Measurement used to be about numbers of clips and share of voice; communicators rarely used it to gather insights.”

While much of the 2018 survey matched closely with the 2019 edition, the new report indicates communicators have a slightly more sophisticated relationship with data, measurement and analytics.

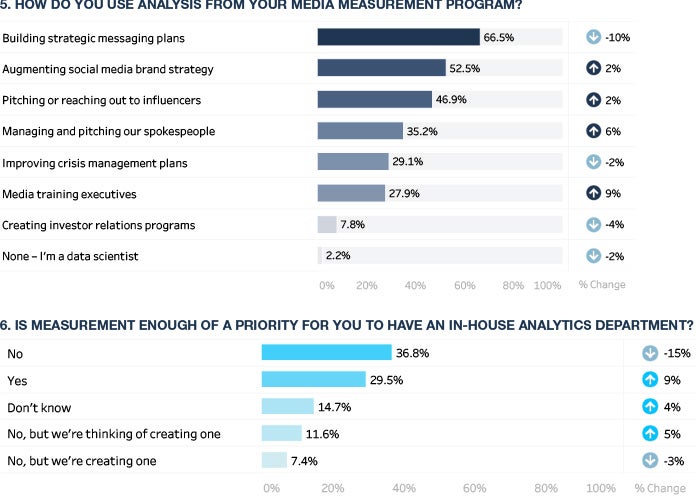

For example, the question of measuring or not seems moot. We asked, “Is measurement enough of a priority for you to have an in-house analytics department?” 37percent said no, which was down 15 percent from the 2018 result. 30 percent answered yes, which was up 9 percent from the previous year (see chart 6).

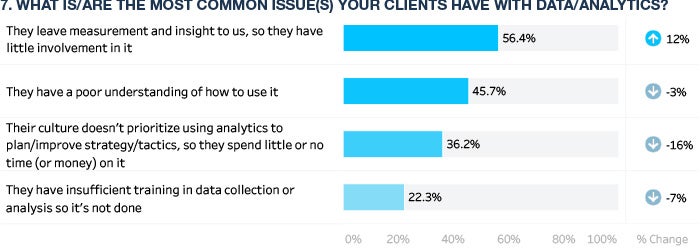

Not all is sanguine. We asked, “What is/are the most common issue(s) clients have with data/analytics?” Slightly more than half (56 percent) said clients “leave measurement and insight to us, so they have little involvement with it.” That rose 12 percent from ’18 (see chart 7).

21 percent say their companies lack a “formal measurement program,” up 5 percent from 2018, as the last column in chart 5 shows.

Still, concern for many resides at a higher level, with issues such as data quality, for example. In the 2019 survey, 16 percent said they “rarely have good data” to make decisions. In 2018 that was just 7 percent.

[A related issue, though not covered in the surveys, is that PR “is tired of working with garbage data,” Koefoot says.]

Another sign of measurement maturity is the increased interest in gaining insights from data, as opposed to merely collecting and measuring, the survey shows. A related surprise was that cost and speed are losing ground to gathering insights from data.

The 2019 survey was fielded in October. There were nearly 350 responses.

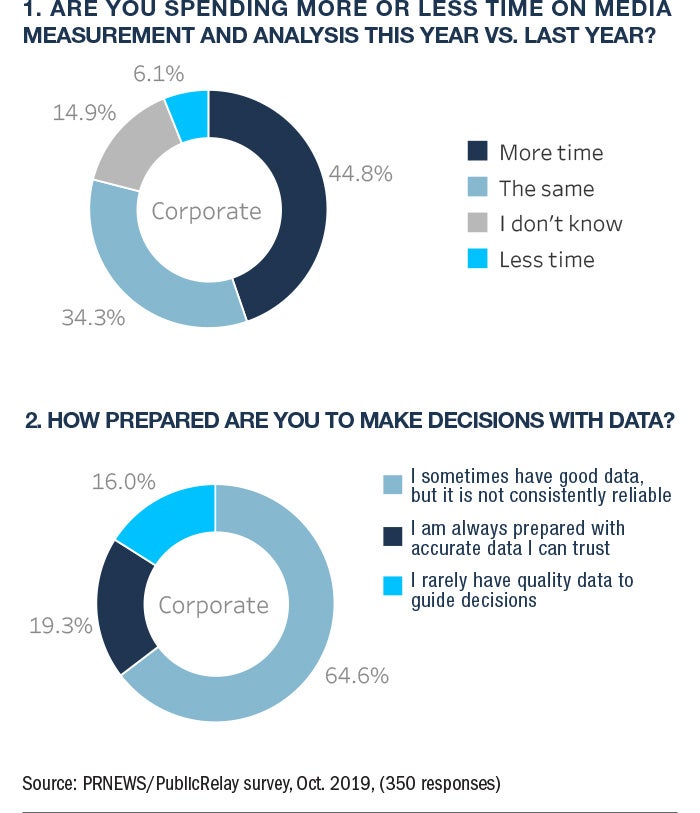

In chart 1 we see positive responses to “Are you spending more or less time on media measurement and analysis this year vs. last year?” This year’s 45 percent (more time) and 34 percent (the same amount of time) is comparable to 2018’s responses.

In chart 2, as noted above, there’s been an increase of 9 percent from 2018 in those saying, “I rarely have quality data to guide decisions.” Also rising is the response for “sometimes” having good data (65 percent). Obviously when “sometimes” and “never” rise, that’s troubling. Yet Koefoot says this result tracks “with what we’ve been hearing in the marketplace about the softness with hard numbers.”

For him, the finding about poor-quality data mainly is “an awareness issue.” He doesn’t believe the quality of data has risen or fallen in the past year. There are vendors that supply quality data and some that offer second- and third-rate data, he says. Instead it’s that communicators, who rarely looked at data before with a critical eye, now are saying, ‘Whoa! What I have really isn’t that good…it’s not good enough to do my job.’

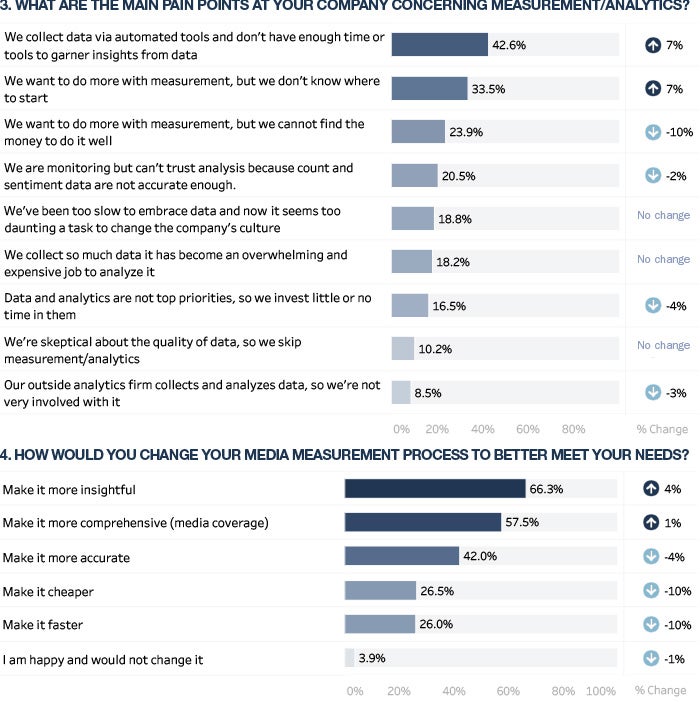

One of the interesting takeaways from chart 3 is that the top three answers relate to wanting to do more with measurement. The largest response, “We… don’t have enough time or tools to garner insights from data” (43 percent) is encouraging and disappointing. This group wants to garner insights, which is good, but is unable to do so.

Not too long ago communicators (and everyone else in business) were fixated on cheaper and faster. Another example of PR’s evolving approach to measurement is seen in the top response in the next chart (chart 4). Some two-thirds of respondents said they would change their data efforts to make them “more insightful” (66 percent, up 4 percent from 2018). “Make it cheaper” and “Make it faster” are two of the laggards; both are down 10 percent since the 2018 survey.

Koefoot believes the “insightful” response is key. “That’s not like I’m counting impressions or [using] AVE…it’s not raw counts…and insightful doesn’t necessarily mean dollar sales attribution either…Insightful is what’s working. Who matters? Why do they matter? How do I make my limited budget go farther? How do I work smarter…what strategically is working and why? Where is my competition strong? Where is it vulnerable? Where am I strong or vulnerable?”

Chart 5’s findings are unsurprising. To be sure, that 21 percent lack “a formal measurement program,” up 5 percent from 2018, is disappointing. The top three responses “are variations on proving and measuring PR’s worth…it’s really measuring outcomes,” Koefoot says. “Communications has always had to prove its worth in non-standard ways.”

Editor’s Note: PRNEWS and PublicRelay will be sending you the full survey later this year.

CONTACT: peter.walker@publicrelay.com