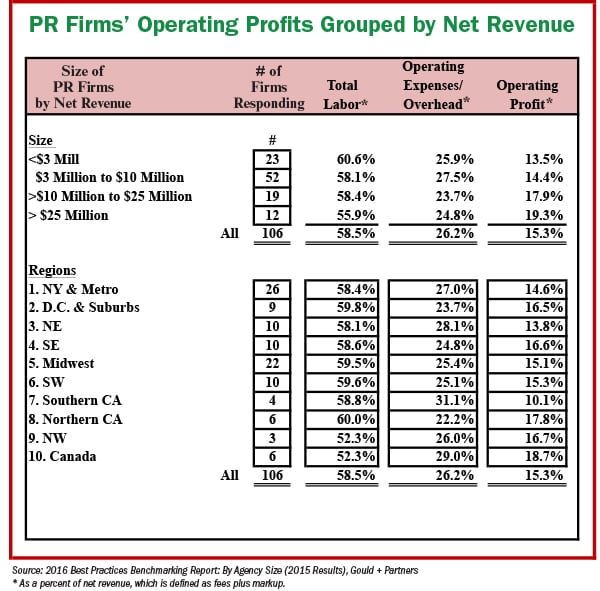

Confucius said, “Life is simple, but we insist on making it complicated.” The same holds for PR firms and profitably. Data supplied exclusively to PR News Pro by Gould + Partners reveals none of the 106 PR firms, which were grouped by net revenue, reached 20% profitability, the industry benchmark. Individually, some firms polled for this 2016 study had 30% profitability, others were far less. The groups failed to reach 20% profitability in the ’14 and ’15 surveys, too.

The group of 6 Canadian firms (Line 10) was more profitable than its U.S. counterparts. The reason is simple: “The Canadian CEOs keep a closer eye on base labor” costs, says Rick Gould, managing partner, Gould + Partners. As U.S. firms provide staff with raises and incentives, billing rates remain relatively stable, which cuts into profitability. The goal for labor costs is 55% and 25% for overhead, Gould says.

Why are U.S. PR chiefs averse to raising client fees? “They fear client pushback,” says Gould, who’s been monitoring the industry for 30 years. He advocates firms employ CFOs, even part-time, to monitor labor costs.

Nearly 85% of firms surveyed return annually, Gould says, naming Edelman, Finn Partners and Taylor. On the upside, Gould is “thrilled” with PR’s growing net revenue of 8-10% annually. “I thought with that sort of growth, we’d see profitability come closer to 20%, but we didn’t.”