Although Twitter has been around for a decade, never in its history have 140 characters had the power and influence they’ve enjoyed since Nov. 9. Sure, when the Pope began tweeting, it made headlines but it didn’t move markets the way @realdonaldtrump has in the last few months. One outlet estimated that one 140-character screed about Lockheed Martin cost the company $28 million per character.

But as it happens, it’s not always bad to be caught in Donald Trump’s crosshairs. In the wake of the criticism of Rep. John Lewis (D-GA), Amazon sold out of his most recent book. Vanity Fair and New York Times subscriptions have skyrocketed after angry tweets from then-president-elect Trump took them on. Some organizations might want to develop a PR strategy that cultivates antipathy in order to boost donations.

But even for brands that sustained damage, the financial impact seems to be relatively short-lived. This, of course, is little consolation to the war rooms and board rooms whose occupants are no doubt drawing up crisis communications plans to make sure they’re prepared to withstand the eventuality of

a Trump attack.

No doubt, most of those plans include standard crisis preparedness advice: Develop good relationships beforehand, don’t engage, take it offline, etc. Those ideas might work if Trump behaved in a predictable way. Alas, predictability seems as anathema to the POTUS as releasing his tax returns.

The difference between normal crises and a Trump-induced one is that most don’t have automated stock trading programs developed around them. The other problem is that Trump crises develop a lot partisans, on both sides of issues. Evidence includes a website of brands to avoid should you oppose Trump [see: https://grabyourwallet.org].

The other major difference between your average social media blunder and a Trump tweet is a simple rule of journalism: Whatever the president says or does is news. So chances are good that whatever the president tweets at 3 a.m. will be picked up by most major news outlets, repeated and retweeted by his core followers. In other words, widespread exposure on most major news outlets will be instantaneous.

On the other hand, the news media has enough to keep it busy these days. It’s hard to keep its attention for very long. If you’re lucky, it will fade from the headlines and be repeated only as an example when another tweet is tweeted. The important thing to watch is not the stock price, but the attitude of investors and other stakeholders.

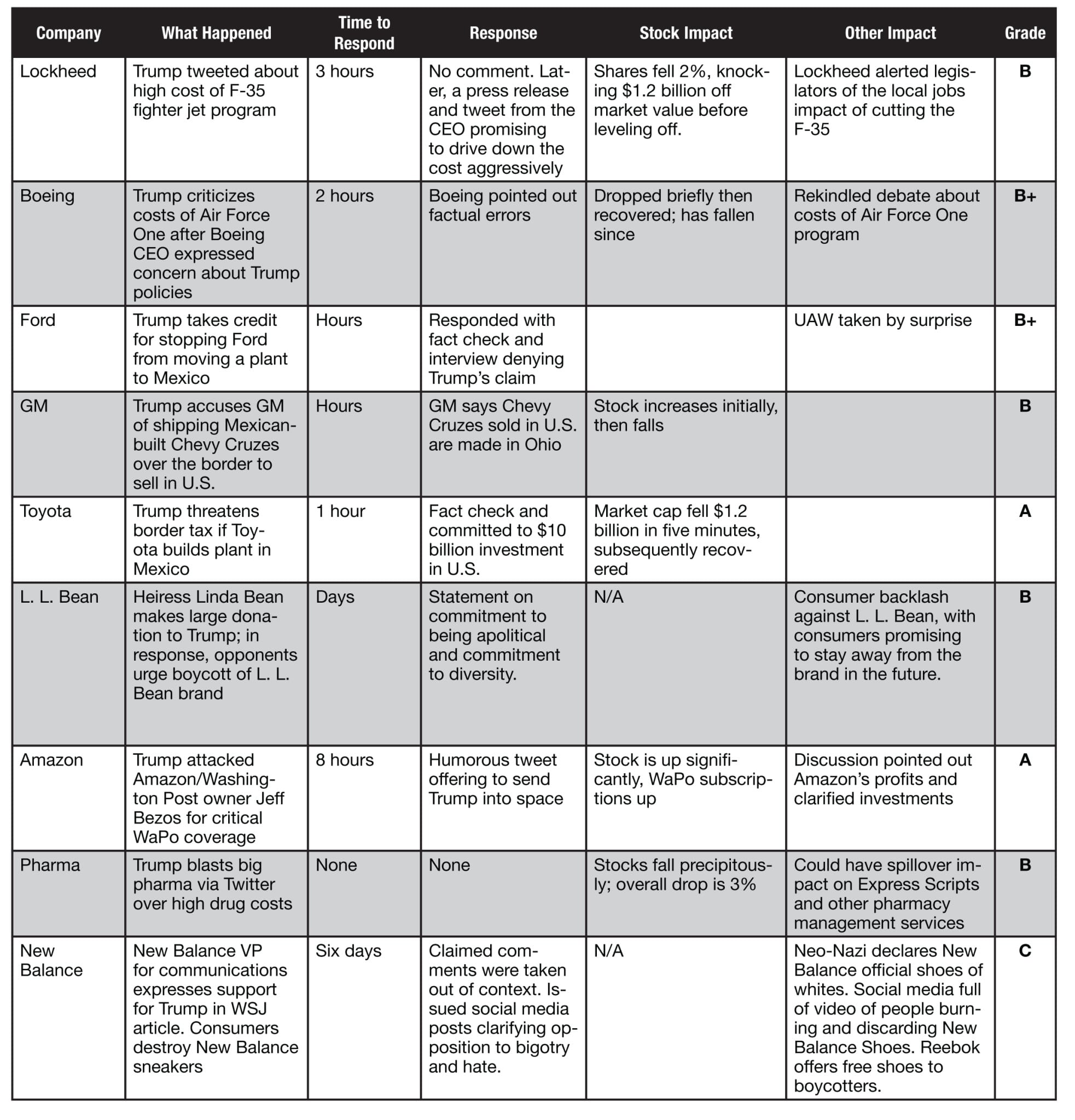

Which is why we decided to do a deeper analytic dive into these crises [please see chart]. We looked not just at what happened, but the short- and long-term financial impact, as well as other impacts, and graded the response.

The takeaways

So what did we learn? Here are six lessons:

- Time is of the essence: What we learned was that no matter what, a fast response is required. If you don’t respond within a couple of hours, all those other voices will fill the vacuum. Get out a statement of fact quickly, revise it if necessary.

- Just the facts, ma’am: Respond with facts. Keep your responses as simple as possible and make sure you fact-check them thoroughly—if you don’t, someone else will. You don’t want to go through this exercise twice.

- Watch the competition: It’s normal to breathe a sigh of relief when the target is your competition, but chances are the market (and consumers) may paint you with a similarly tainted brush. And who knows, there may be opportunity in the backlash. Reebok offered free replacement sneakers when the New Balance fiasco began and no doubt won over former New Balance fans.

- Listen as if you were a day trader: A huge percentage of the stock price movement in the wake of a Trump tweet is the result of day traders and short sellers making money on stock movements. Much of that stock price shock dissipates within days. But day traders aren’t dumb. They have sophisticated listening systems from Trigger and others that alert them to statements that might trigger a move. You need a system just as good.

- Listen to your stakeholders, not the noisiest person in the room: What matters ultimately is the opinion and actions of your employees, customers, supporters and community. Make sure you survey them regularly and have recent benchmarks against which to compare shifts. The Edelman trust barometer shows a shocking decline in trust. It won’t take much to lose your constituencies’ trust. Remember, it’s the long-term trends and shifts in perceptions, not the initial jumps or slumps.

- Learn from those who have fallen: By now we have a fairly good idea of what action or statement may land you in POTUS’ crosshairs. So have a frank conversation with leadership about scenarios such as: offshore expansion; U.S. expansion plans; layoffs; price increases; international mergers or tax inversions; private rants by senior execs about the president or his policies that might have been recorded.

Most important, do not measure success in the short term. What matters is the long-term impact on your reputation and the degree to which any crisis has touched your trust level.

This content appeared originally in PR News Pro. For subscription information, please visit: https://www.prnewsonline.com/about/info

CONTACT: [email protected]