Let’s be clear: ESG is not a PR endeavor.

Applying metrics to operational and cultural standards is an ethical and business imperative. And it should drive business strategy.

However, communicators play a critical role in facilitating ESG adoption internally. In addition, they relay goals and performance externally.

Moreover, with organizations rightly under fire for 'greenwashing,' communicators have a responsibility for substantiating public ESG claims with evidence and action. While the upside for reputation associated with ESG commitments is strong, the risk of neglecting them is stronger.

As such, communicators who understand ESG risks and opportunities can help companies create, achieve and publicize goals and initiatives for sustainable success. Below are some things they should consider:

Put Communication at the Center of ESG Strategy

Like nearly everything else in PR, authenticity is integral to effective ESG. After all, goals are easier to achieve when they align with company values and the communities you touch.

Companies that are unsure about connecting ESG values with operations may benefit from internal surveys. These should assess employees' most pressing ESG issues. As such, they can help identify and develop initiatives that track with values. Similarly, they may incentivize teams to meet corresponding ESG commitments.

For example, a company with employees who care about animals might tie quarterly sales goals to American Society for the Prevention of Cruelty to Animals (ASPCA) donations.

Placing communication at the core of ESG strategy will illuminate for employees and other stakeholders why ESG is important and how it influences them.

Preach What You Practice

Organizations face enormous pressure as champions of many causes.

However, sometimes it’s better to be more impactful on fewer issues rather than engage on many topics without thoughtful plans or clear goals.

Accordingly, communicators should take care to highlight the ESG initiatives that management intends to execute with demonstrable action and concrete plans.

For instance, include impact statements in client-facing newsletters or celebrate a charitable goal reached via press release.

Unintentional Harm

A Bliss Group and Ringer Sciences analysis of a proprietary database of 500 CEOs and CFOs found company ESG scores were negatively correlated with the volume of corporate social posts that focus on values around workplace inclusivity, but lack supporting metrics.

This suggests that without clear KPIs and transparent reporting, publicizing ESG-related goals can harm brand reputation. And this is so even if ESG initiatives align with corporate values.

Share ESG successes and failures with internal and external stakeholders as appropriate. You might want to display this information as goals set and progress made in a report or a presentation.

Second, resist the temptation to scrub unflattering metrics from content. Reporting less-than-ideal metrics can work in a company’s favor if you also include an action plan that demonstrates strategies for improvement.

Integrate ESG into Operations

The shift toward more socially and environmentally conscious operations has prompted companies in all industries to create and fill Chief Impact and Sustainability Officer roles. While prioritizing dedicated ESG leadership is a good step, the work cannot stop there.

Successful ESG initiatives are pervasive, sustainable elements of organizational culture. As such, avoid relegating ESG to a single professional or siloed committee.

When your goal is real change, ESG must be a cross-departmental endeavor. In addition, closely and expressly link ESG with value creation and growth strategies. Note that one in four investor dollars flow into ESG strategies.

Make Members of the C-suite Your ESG Champions

ESG is an important part of operations and culture. Integrate ESG with your C-suite’s thought-leadership strategy. Making ESG a part of the C-suite’s thought-leadership output is an effective way to help investors and socially conscious consumers put a face on your ESG strategy.

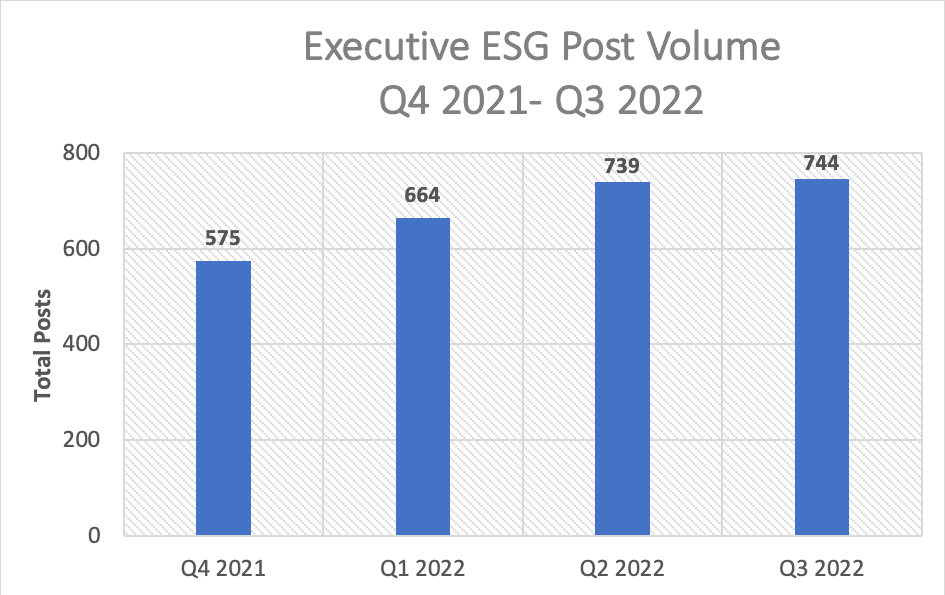

Bliss and Ringer’s Executive Signals Platform found ESG is becoming a much more important topic of commentary for executives on LinkedIn. The volume of senior leaders’ ESG-related posts has increased steadily, with 12% more content published and shared in Q3 vs Q1 2022. This could be because of the response it elicits from an increasingly socially conscious public.

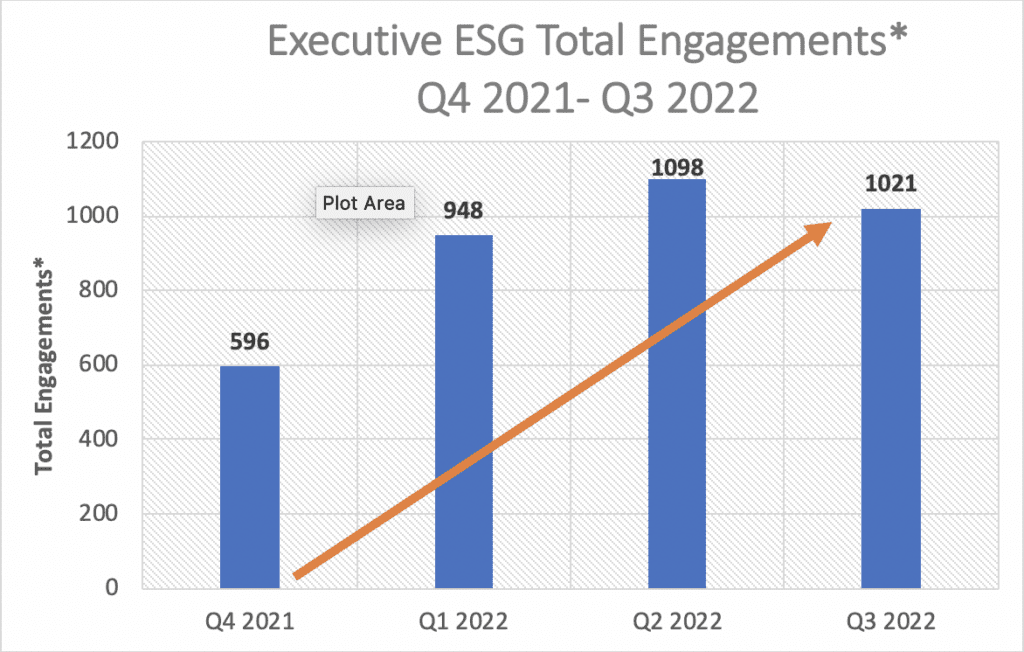

From a proprietary panel of C-suite executives on LinkedIn, analysis found ESG content receiving increasing engagement (reactions, comments, shares) since January 2022, up 8% in Q3 vs Q1.

Notably, top posts did more than summarize–they shed light on executives' perspectives, demonstrating a desire to see personal connection and commitment to company values. Nearly all (93%) consumers believe CEO social media activity helps convey company values, shape brand reputation and develop corporate leadership during a crisis. Support executive statements with comprehensive action at every stage.

Don’t Talk Without the Walk

Communicators are adept at helping companies talk the talk, but evolving consumer and investor tastes demand companies also walk the walk. Communicators should help shape strategy according to ESG analysis to boost brands’ reputation and ensure that impact aligns with stated intentions.

Cortney Stapleton is managing partner, The Bliss Group

Garrett Bond is director, analytics, Ringer Sciences