|

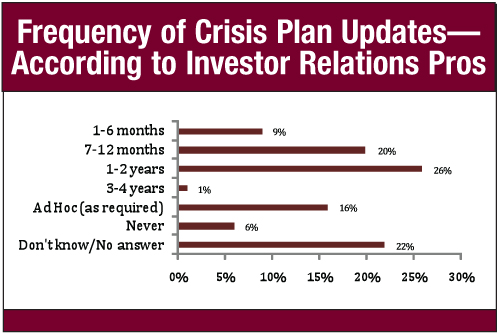

| Are IR professionals out of the loop when it comes to crisis communications? According to this April study by Fleishman-Hillard and the Canadian Investor Relations Institute, a whopping 22% don’t even know (or won’t answer) if their crisis plans are updated. Source: Fleishman-Hillard/CIRI |

The biggest mistake companies make during a corporate or operational crisis is a lack of communication and transparency with stakeholders and employees, causing a negative impact on valuations, according to a survey released by the Canadian Investor Relations Institute (CIRI) and the PR firm Fleishman-Hillard.

The survey of financial analysts and investor relations professionals at companies across Canada and the U.S. on operational and corporate crisis preparedness found that while many companies are mindful of the potential damage crises can cause to their sales, reputation and share value, few have an effective crisis management plan in place—and if they do it is likely out of date.

Further, the survey found that half of responding IR pros from the financial services and healthcare industries claim they don’t follow a crisis communications plan at all.

Those findings aren’t surprising to Alexander Laskin, assistant professor of public relations at Quinnipiac University. His own research finds that many investor relations pros are not prepared for managing crisis communications. “In fact, they are not prepared for managing any kind of communications,” says Laskin. Investor relations pros often do not have PR backgrounds and work in treasury or corporate finance departments. “Even those who work in stand-alone investor relations departments report to the CFO rather than the CEO,” continues Laskin. “It’s naïve to expect accountant and financiers to be proficient in managing communications; it is like letting your legal department run your media relations.”

Kathy Fieweger, executive VP at MWW Group, agrees, and takes it a step further. “Traditionally, the IR function often reports in to the CFO, who may or may not be part of a broader operations risk management team,” says Fieweger. Corporate crisis planning often falls to the head of PR, the general counsel or a COO, she says. “In some cases, it is not clearly identified who is actually in charge of crisis planning.”

As a conduit between analysts and the company, it’s imperative that IROs play a lead role in developing the communications plan. But according to the survey:

• 50% of IR respondents don’t know if the crisis communications plan is updated after a crisis.

• 50% of IR respondents don’t know if their company conducts crisis simulations.

• Only 19% of responding IR pros contribute to the corporate blog, which was deemed as an important source of information by analysts.

Claire Koeneman, president of the Financial Relations Board and global leader of the corporate communications practice at MWW Group, believes IR pros need to be tuned in to social media platforms in a crisis—if not so directly then through corporate communications staff. “In social media, the tone of an approved response may need to be different than standard communications to analysts, while keeping in mind regulatory considerations,” says Koeneman.

What’s an organization to do to bridge the chasm between IR and PR? Laskin says companies should integrate all communications functions together—media relations, investor relations, customer relations, etc. “Such an integrated department will be efficient at dealing with crises as well as day-to-day communications needs of an organization,” says Laskin. PRN

[Editor’s Note: Learn crisis essentials at the PR News Crisis Communications Webinar on May 12. To register go to www.prnewsonline.com/webinars/2011-05-12.html.]

CONTACT:

Kathy Fieweger, [email protected]; Alexander Laskin, [email protected]; Claire Koeneman, [email protected].