Jack Morton Worldwide recently took the pulse of 4,000 adult consumers in Australia, China, the United Kingdom and the United States. The marketing agency wanted a better understanding of how brand experience impacts consumer choice.

The study defines experience as interactions with products, employees, marketing campaigns, word-of-mouth conversations and social media interactions.

According to the study, 40% of consumers are willing to pay more for a product if the brand offers an interactive experience, something that PR pros should keep in mind as they delver further into content creation.

Here some other salient stats from the survey:

- Overall, 88% of respondents have indicated they are more likely to recommend a brand to a friend or colleague if they have a great experience with that brand; 80% of respondents indicated that they are more likely to choose a brand if they are certain it will ensure a quality experience.

- Fifty-eight percent of the respondents said they would pay more for a product if the brand experience were a great one.

- A great brand experience is especially important to so-called Millennials: 95% of Chinese consumers between 25-34 indicated they are more likely to purchase a product from a brand that offers a great experience, versus 88% in the U.K. and 70% in the U.S.

Source: Jack Morton Worldwide

▶ Gen Y Cares More About Saving and Less About Spending

Speaking of younger consumers, Merrill Edge has released a study showing that affluent Millennials (people born from the early 1980s to early 2000s) are more aggressive about saving than baby boomers (people born between 1946 and 1964).

The study samples “mass affluents,” which is comprised of 25 million U.S households with investable assets between $50,000 and $250,000. Investors in the 18-34 demographic have already saved an average of $55,000, and the average age they started saving at is 22. In contrast, baby boomers started to save when they were around 35 years old, the study said.

Here are some other noteworthy findings:

- Seventy-seven percent of Gen-Yers said they plan to increase their savings over the next year, and 57% said they plan to invest more in the stock market.

- Gen-Yers are optimistic about their financial future and expect to save an average of $2.5 million by the time they retire, versus mass affluents in the 51-64 demographic, who expect to save roughly $260,000.

- Gen-Yers with young children are even more conservative with savings, and pledge that they will spend less on discretionary items such as vacations and new cars so they can save more for their children’s education.

- Ninety-five percent of Gen-Yers with children already have a savings plan for their children’s education, versus 81% of respondents outside the 18-34 demographic. PRN

Source: Merril Edge

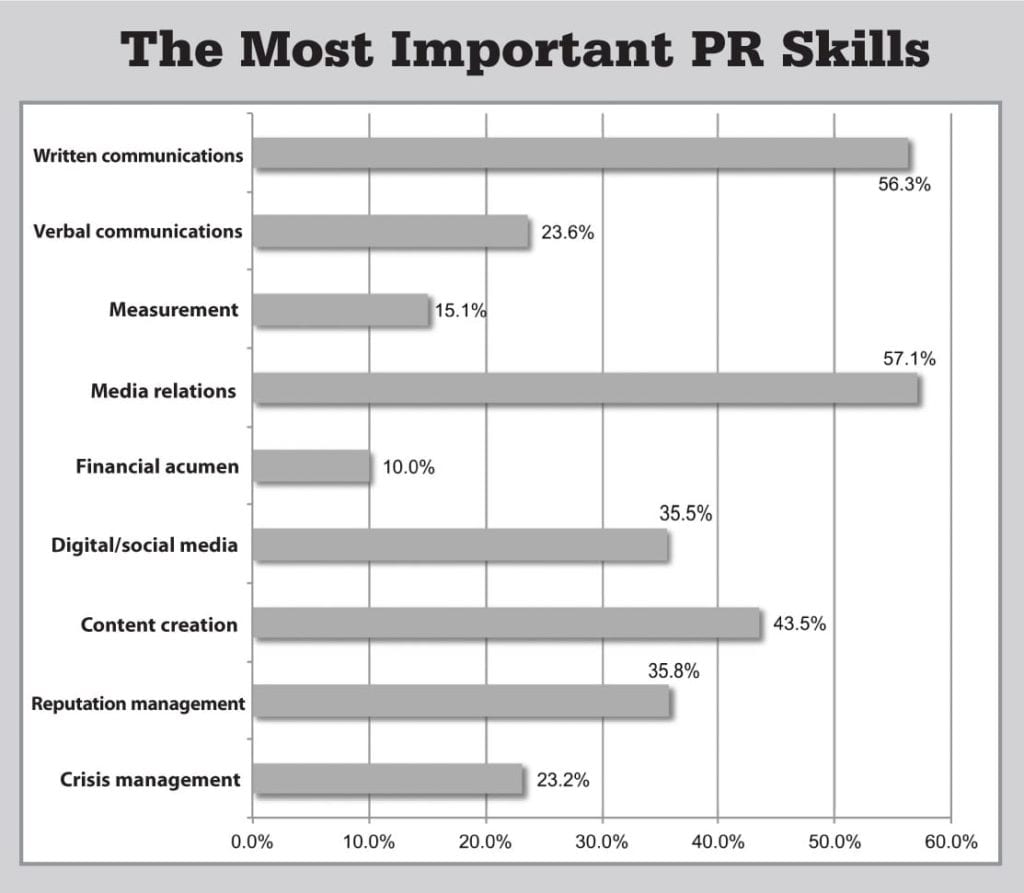

Despite increased emphasis on research and analytics, written communication and media relations remain the most important skills for a PR professional, according to PR News’ 2013 Salary Survey. Still, using digital and social media channels is becoming increasingfly important. For more on the survey, go to prnewsonline.com