|

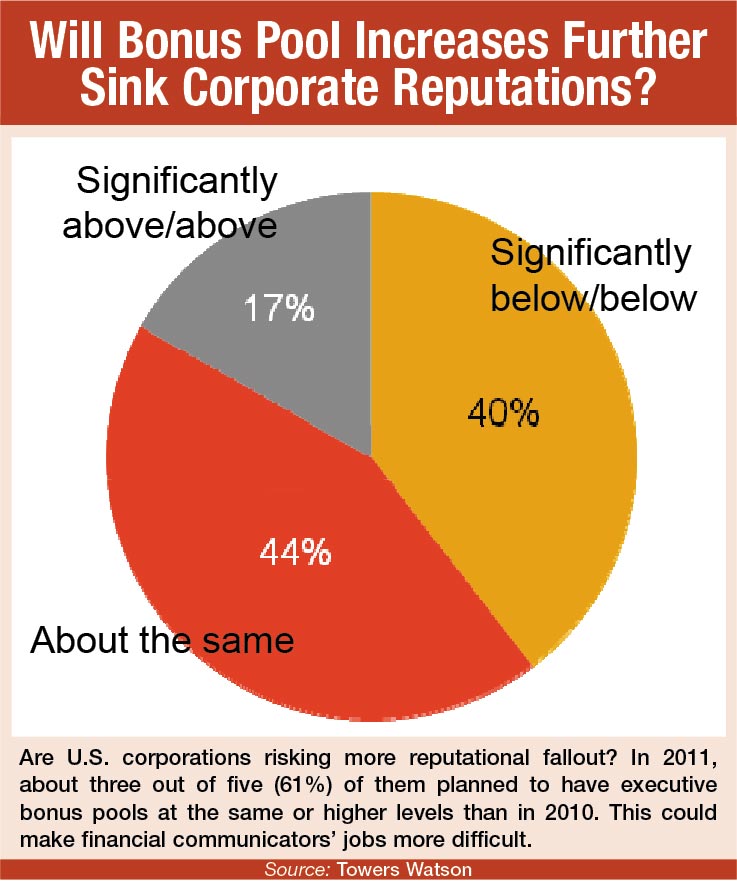

Despite many companies in North America anticipating a decline in shareholder value in 2011, a majority expect executive bonus pools to be as large or larger than those in 2010, says a December 2011 study by Towers Watson.

This puts communicators who work for these companies—as well as communicators in the business community at large—under the gun: Not only must they justify to the public why executives are receiving higher bonuses, they must also explain the bonuses to shareholders as well.

FALL FROM GRACE

It’s a vexing problem for PR, given the lack of trust of the corporate world by the public. From about 2005 to 2007, corporate leadership—effectiveness, honesty, integrity and drive—tended to be the strongest driver of reputation in most industries, with a big impact on bottom-line performance, says Pam Cohen, behavioral economist at the PR agency Dix & Eaton.

But that all changed starting in 2007 and into 2008. Since then, we have seen a growing lack of trust in corporate leadership that ties in closely with transparency—how much is being disclosed about an organization—and the overall perception of corporate performance on the part of stakeholders, says Cohen.

Other findings of the Towers Watson study may exacerbate the problem. Of the 265 midsize to large companies surveyed, 58% expect to fund their annual incentive plans at or above target levels based on their companies’ year-to-date performance. This could be a backbreaker, says Cohen. “If it is in fact true that bonuses will exceed expected performance goals, then corporate reputations will suffer as a result, and this will be compounded by the already damaged view of corporate leadership generally,” she says.

COMMUNICATE EARLY...

What can a financial communicator do? Be proactive with shareholder engagement, says Gene Marbach, group VP at Makovsky + Company. Transparent discussions with shareholders about their compensation practices are critical. Explanations must be plausible.

In cases of companies that have declining shareholder value, they may have some mitigating factors. For example, says Marbach, companies that are experiencing declining shareholder value may have a need to lock in and retain critical executive talent.

Whatever the explanation, corporations need to understand that large institutional shareholders and individuals are demanding a greater understanding of how executive compensation is determined, says Marbach.

...AND OFTEN

Lisa Rose, senior managing director at Dix and Eaton, recommends communicating pay issues often. Open and transparent communication around executive compensation is something that should happen on an ongoing basis with shareholders over the course of the year, not just during proxy season. “And, the information must be presented in a way that shareholders can then make informed judgments,” she says.

Whether that will ultimately appease stakeholders, including a frustrated public, is anybody’s guess. PRN

CONTACT:

Pam Cohen, [email protected] Gene Marbach, Gene Marbach, [email protected]; Lisa Rose, [email protected].