If you want to demonstrate that the media coverage you generate is related to business results, an updated metric is available to help you do just that.

A new white paper published by the Institute for Public Relations Commission on PR Measurement & Evaluation entitled, “Media Cost Weighting: A New Paradigm,” demonstrates the superiority of the Media Cost Weighting metric with four rigorous case studies. The conclusion is it works far better than other quantitative metrics, including impressions—the de facto industry standard.

Critics of the metric claim it is just “ad value equivalency” (AVE) in sheep’s clothing. AVE is essentially the old-fashioned practice of assigning a “value” to a news story by equating it to advertising costs, with the implication that the news story is “equivalent” to an ad in terms of probable audience impact.

The paper shows that the underlying metric actually measures the medium itself through real market value. The paper concludes that including media costs works far better than other quantitative metrics when linking media outputs with business outcomes.

Why should you care? As PR practitioners, one way we earn our living is by generating communications designed to change audience attitudes and behaviors. Sometimes we are able to show the direct impact of our communications. However, the great majority of practitioners can only show indirect benefit by following a trail of linkages to outcomes like leads, sales, survey scores, etc. So the question is: What metrics help you do this best?

To evaluate a story for comparisons over time against objectives or business results, one must score it for both quantitative and qualitative factors. Quantitative methods tend to be story counts, audience impressions or the cost of media space/time—which we’ll call “Weighted Media Cost” (WMC). Qualitative methods include tone, key messaging, prominence, dominance, article type, etc. Since two previous IPR Commission white papers have laid a foundation for the fact that tonality-refined media coverage does correlate with business outcomes, this particular paper goes the next step in asking: Which of the three quantitative metrics work best when refined by tone (or “net positive”)?

RIGOROUS TESTING, POSITIVE RESULTS

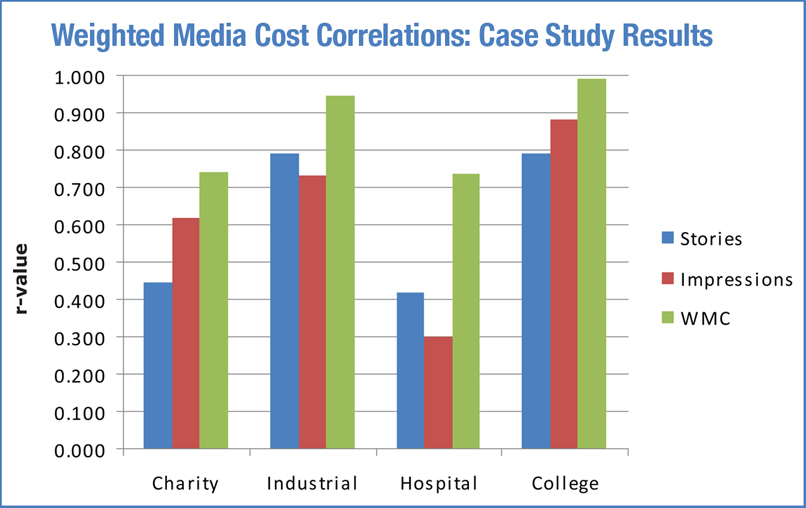

To test this, four case studies were conducted, scoring thousands of clips for clients and competitors comparing the three metrics: net-positive story counts, audience impressions and WMC. Clips were then compared to business results through simple Pearson Correlations. (Stay tuned for how to do a correlation.)

The first case study looked at more than 14,000 articles for a Christian charity for 31 days during the 2008 Myanmar disaster. The results were plotted against daily funds raised, with and without lead-lag time periods. Without question, net-positive WMC outperformed the other two metrics. Had the client relied on story counts, he may well have concluded his media campaign had little relationship to funds raised. (Let's clarify that WMC does not always produce high correlations, but compared with the other metrics, it consistently produces better correlations.)

The other case studies were for a B2B for industrial power conditioners, where the three metrics were compared against sales; a major Wisconsin hospital where the comparison was against top-of-mind survey scores; and five colleges where the comparison was against parental preference scores. The summary chart on this page shows that in every case, net-positive WMC outperformed the story counts and audience impressions.

Why is this so? There are a number of reasons: media costs are objective, market-driven numbers that reflect size of audience, credibility of source, the perceived ability of a source to drive outcomes and the prominence of the coverage. WMC also does a better job of differentiating the impact of various media types through market-driven costs, so an Internet impression is not given the same impact as a television impression.

AVE VERSUS WMC

So how can you use WMC to your advantage? Let’s start by clearly differentiating AVE from WMC:

• Ad Value Equivalency infers a direct comparison to advertising in terms of impact; it assumes equivalence with advertising even though there is a great divergence in messaging in news versus homogenous messaging in advertising; and, the absolute dollar amount has been incorrectly used as an outcome measure. Historically, practitioners use the highest numbers possible and multiply them for “credibility” over advertising; make no allowance for negative tone; and often include credit for the entire article without regard to how much space or time is actually “owned” by the client.

• Weighted Media Cost is the practice of utilizing the cost of media for the broadcast time or print/Internet space occupied by a client as an objective market proxy number for comparative analysis against historical performance, against objectives or against competitors. The absolute number itself has no meaning or value beyond that of any index used for comparisons of any kind. Proper use includes the subtraction of all negative coverage; assigning costs to only the space or time occupied by an organization; using audited, negotiated media costs to the extent possible; and refraining from claims that WMC scores are outcomes of PR campaigns.

|

| Summary of correlation scores (r=values) of all four studies between the three comparative metrics and their outcome scores. Chart courtesy of VMS |

PUTTING AVE TO USE

So finally, how do you actually use Tonality-Refined Weighted Media Cost to compare your media coverage to business outcomes? Try this simple formula:

1. Score your media coverage qualitatively and quantitatively. Calculate WMC for each article and score each clip for tone (at a minimum). Calculate a “net positive” score by adding positive plus neutral WMC and subtracting the negative. For the best results, measure competitive coverage the same way and calculate your firm’s “Share of Discussion” percentages. (For more, see “Exploring the Link between Share of Media Coverage and Business Outcomes” at www.instituteforpr.org).

2. To calculate a correlation. On a blank Excel worksheet, enter your time intervals (months, quarters, years) across the columns on row 1, your net-positive WMC on row 2 and your business outcome scores on row 3. Use the same time intervals all the way through.

Then, in an empty cell, use the formula below to compare the cell numbers of the starting and ending values in rows 2 and 3: =Correl(B2:G2,B3:G3). Simply hit “enter” and you’ve got your correlation.

In PR, correlations of.7 and above would suggest that your efforts and business outcomes are moving in the same direction, though it does not prove causation.

Try applying Weighted Media Cost to selected campaigns: the possibility of further proving the value of PR is too great not to. PRN

CONTACT:

This article was written by Angela Jeffrey (angela.jeffrey@vmsinfo.com and Dr. Brad Rawlins (brawlins@byu.edu); it is based on the recent white paper on behalf of the IPR’s Commission for Public Relations Measurement and Evaluation. For a full version of this article, go to www.prnewsonline.com.