The relationship between a public company and the investment community has changed significantly, as U.S. policymakers changed the “rules of the road” on Wall Street in the wake of declining investor confidence and corporate scandals. With these changes, coupled with the indelible effects of the Great Recession, it’s become a whole new ball game for communicators working for public companies. We all know the chain of events: first came Regulation FD (“Reg FD”), then the Sarbanes-Oxley Act (“SOX”) and then, finally, the $1.4 billion settlement between then-New York State Attorney General Eliot Spitzer and the Wall Street banks.

Typically overlooked in the ongoing debate related to these actions is the undeniable impact that each has had on investor relations and PR:

• For most companies, the increased legal influence in this area resulted in a decreased level of context and market commentary in company disclosures.

• SOX created an equally strong voice for accounting firms and auditing firms working in investor relations, further dampening the level of information being provided to investors by many companies.

• The settlement triggered a domino effect that greatly damaged the traditional communications channel between companies and investors.

Many investors also lost, as they were left without a key source for investment ideas and company/industry data.

The cumulative effect of all these developments was compounded by technological advances, and resulted in an extremely difficult and volatile environment for companies to compete for capital.

Yet, even as the pitch of “the Street” has gotten steeper, and the pace faster, IR/PR strategies and tools for most companies remain largely staid.

“IR continues to get more primitive as the markets keep getting more sophisticated,” said a senior institutional fund manager. The timing of this dichotomy could not be any worse.

Research continues to show that an effective IR program can create a median premium of 10% to valuation, while an ineffective program can cost a median discount of 20% to valuation, according to a report released last summer by Rivel Research.

Among other things, effective IR can provide investors with insight into a company’s growth potential and the strategy by which it will achieve this growth.

Yet, many companies limit their narrative to historical results and don’t tell the bigger story about the brand.

Some of these limitations are certainly the result of regulatory changes that caused many companies to view IR predominantly as a compliance function.

It also is due to the fact that those who work in corporate IR now largely come with a financial background rather than a communications background.

A 2012 study conducted by the National Investor Relations Institute and Korn/Ferry International found that more than 40% of Investor Relations Officers (IRO) surveyed previously held accounting or corporate finance positions, compared with 12% with a background in corporate communications or public relations.

PROVIDING THE CONTEXT

This is not to say that the IR function is completely broken. As a compliance and financial reporting tool, IR is as good—if not better—than it has ever been. And this is critically important as no sustainable IR/PR program can be built without this foundation.

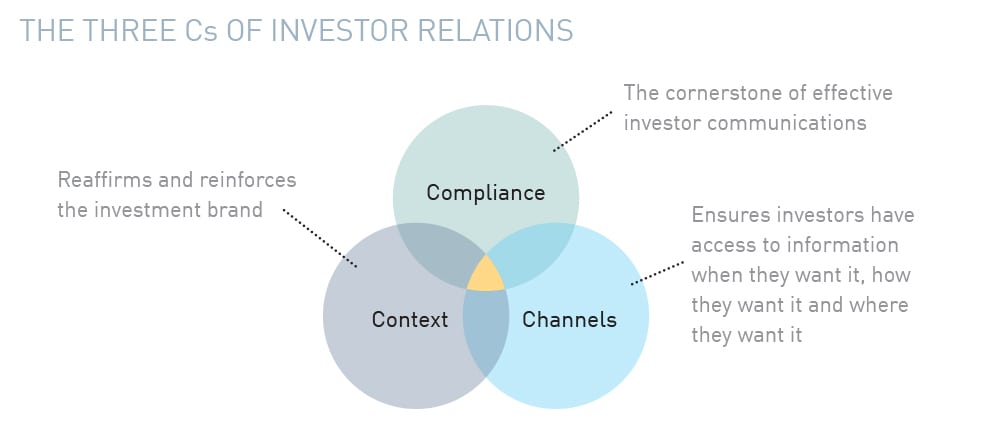

But compliance is only one-third of effective IR today; the other two-thirds being context and channels. In order to engage investors and enhance value effectively through communications, IR also needs to complement and support its compliance mandate with sophisticated branding and marketing strategies.

By using all three of the “3Cs of IR,” companies can create an authentic and differentiated “investment brand” that cuts through the daily noise of stock traders and enables them to make genuine connections with long-term investors (see graphic above).

The investment brand not only reflects the central essence of the company, but also speaks to the company’s competitive advantages.

To quote Matt Sonefeldt, who heads up investor relations for LinkedIn, “Storytelling who you are equals the future direction of building a relationship between public companies and long-term focused investors.”

The time has come to rethink IR. Companies that cling to the status quo, and communicate that way, are leaving money on the table. PRN

3 Ways to Enhance Your (PR) Stock

Companies that simplify the complexity of their enterprises and neutralize potential value deflators have a competitive advantage in the financial markets. Investors do not want to search for the information they need to make investment decisions. For this reason, it is equally advantageous to make the company easy to follow by bringing a marketer’s approach to developing a diversified channel strategy to ensure that investors have access to desired information when they want it, how they want it and where they want it. Here are three ways to embolden your company’s appeal with the investment community.

1. Ask yourself tough(er) questions:

Why is now the right time to invest in your company?

What makes your peers more attractive to investors?

What don’t investors fully understand/appreciate about the company?

What does your performance-to-expectations ratio—the “P/E ratio” of investor relations—look like and how can it be improved?

2. Think like a brand strategist:

What is your “investment brand?”

What makes your investment brand authentic?

What differentiates your investment brand?

How can you ensure every touchpoint genuinely reinforces your investment brand and is relevant and meaningful to your stakeholders?

How do customers and employees fit into this?

3. Act like a marketer:

How can you simplify the complexity of your enterprise and deflate potential value inhibitors?

How can you make it easier for investors to stay current on your company?

What’s your channel strategy and how can you better capture and maintain investor interest?

What’s your feedback loop and how are you monitoring potential threats to your investment brand? —R.B.

CONTACT:

Robert Berick is managing director of Falls Communications. He can be reached at [email protected].

This article originally appeared in the April 14, 2014 issue of PR News. Read more subscriber-only content by becoming a PR News subscriber today.