For those of you considering selling your firm or acquiring one, it’s important to know that valuing PR agencies is an inexact science and a complex process. It takes financial expertise, knowledge of the M&A marketplace and an understanding of how buyers create offers/term sheets.

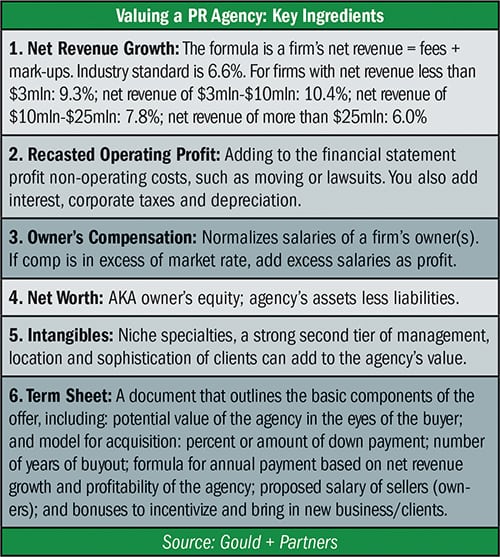

Every valuation is different; so is every firm. PR is a business where financial performance, recast for many adjustments and intangibles, determines an agency’s value. Relationships with clients, depth of second-tier management, specialties and fees also may influence value.

Generally there is an element of subjectivity in valuing a firm, but there are objective rules and guidelines, too. In addition, extensive work is performed prior to conducting the valuation report. In today’s earn-out model, a majority of the value will be in future performance.

Term sheets, presented by buyers to sellers, are customized based on: recasted operating profit for the past three full years, plus current interim period operating profit (i.e. four months ended April 30, 2016); net revenue (fees + markups) growth for the same periods; net worth of the firm as of sale date; working capital (current assets less current liabilities) position as of sale date; and intangibles, such as second-tier management, quality of staff and clients, client contracts in place and percent of the client portfolio the largest clients comprise.

The goal is that terms are fair for seller and buyer. There is no cut-and-dried statement that can be made about how a buyer values a seller. A topline model is based on a percent of net revenue, as collected, for roughly four to five years.

No matter the model used, the goal of the buyer is realizing a return on investment (ROI). Without ROI, it is a bad investment. Consider the below when evaluating an agency:

1. Contrary to popular belief, firms are not valued at a multiple of net revenues.I recently got a call from a client saying he read firms with 25% operating profit could be valued at 3X revenues. He was ecstatic, thinking that his $4 million firm was worth $12 million. He also was told if the agency had an operating profit of 25% (his was 26%) the seller could get half the value, $6 million, at closing, for his $4 million PR agency. I assured him that no buyer would ever offer terms so favorable.

2. Be very careful what you believe.There are people writing about valuation who are clueless. It is a sales pitch to get business. Buyers seek to minimize risk. The down payment is their risk. For a $4 million agency with a 25% operating profit, the seller may receive 20%-35% at closing. The seller may also get less, depending on several factors. The balance will be paid over a four-to-five year period based on performance. This is the earn-out model.

3. The past determines the down-payment percent. The future determines the ultimate amount to the seller. The multiple used for valuation and payment averages 5X EBITDA, or earnings before interest, taxes, depreciation/amortization.

Often a sliding scale is created in which the multiple may be less or more if certain goals are met regarding top- and bottom-line growth. An earn-out can be described as a deferral portion of the purchase price conditional on the seller’s achievement of predetermined operational or financial goals within a specified time frame. Firms with historically flat net revenue growth and operating profit of less than 15% will receive lower multiples, valuation and down payments.

4. Buyers may offer other revenue-based models.In a revenue-based model, the seller’s main function will be to bring in quality business. The buyer will be responsible for operating profit. A revenue-based model can be very lucrative for a seller who is a good rainmaker but, for whatever reason, has not been very profitable due to poor staffing, back-office woes, lack of capital, excessive rent or losing pitches as a result of being too small. With a larger firm, the seller will have the financial and intellectual capital needed to grow top and bottom lines. The revenue-based model has become much more prevalent in today’s PR M&A marketplace, and a valid option for a growing number of sellers.

[Editor’s Note: Some of this material, exclusive to PRN readers, is adapted from Gould’s just-published book, Doing It The Right Way: 13 Crucial Steps For A Successful PR Agency Merger or Acquisition.]

This content appeared originally in PR News Pro, August, 22, 2016. For subscription information, please visit: https://www.prnewsonline.com/about/info

CONTACT: [email protected]