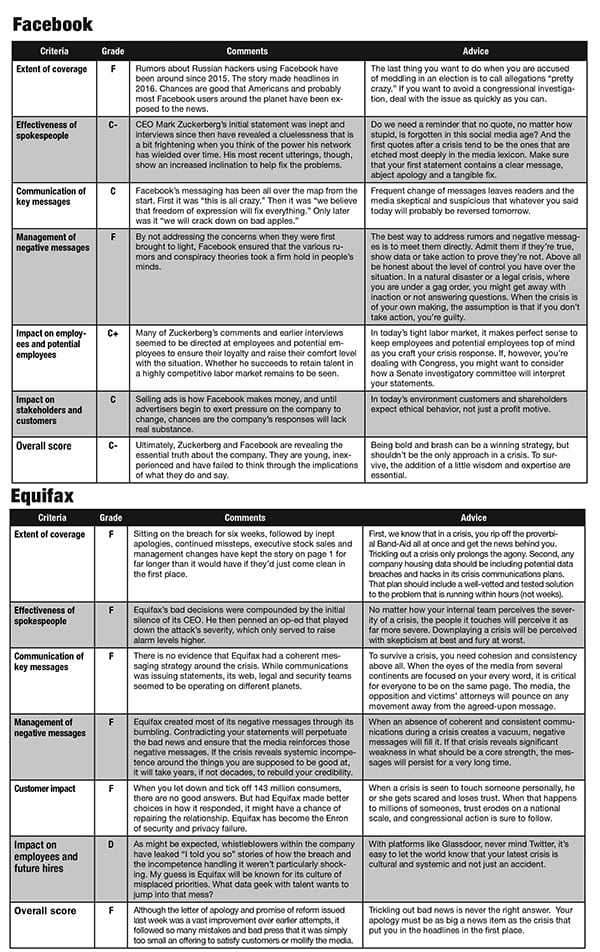

The lesson learned from the most recent PR crises is that the length of time you sit on a problem is directly proportional to how long it will take people to forgive you. Had Facebook CEO Mark Zuckerberg not ignored the impact of Russian trolls since 2015, he might not be facing a hostile Congress and Special Counsel Robert Mueller’s probe. Similarly, had Equifax not sat on the news of its data breach for six weeks, it might not be facing nearly two dozen class-action lawsuits and this week’s congressional hearings. The second corollary is that the more pervasive you are in a person’s life, the more people will pay attention to your scandal. Had Equifax been cursory to borrowing money and getting credit for more than 40% of Americans, and had 70% of Americans not been Facebook devotees, both scandals might have disappeared from the headlines by now.

As far back as 2015, pro-Ukrainian Facebook users were complaining to the company that Russian trolls were flooding the site with fake pro-Russian news and fabricating complaints against Ukrainian users that caused their accounts to inexplicably be shut down. When Facebook was accused of spreading misinformation during the U.S. elections in 2016, Zuckerberg dismissed the notion as “pretty crazy.”

Nine months later Zuckerberg was forced to admit Facebook sold at least $100,000 worth of ads to Russian “advertisers” and those were just the ads it could track easily because they were paid for in rubles. While Facebook is pledging cooperation with Congress and revamping its policies to bar fake accounts, it is highly unlikely the issue will go away soon.

Equifax

Before last month’s crisis broke, Equifax was a company most of us only heard of if we were trying to correct our credit score.

But then news broke that hackers infiltrated its data and accessed the credit and other personal information of nearly 50% of Americans. If that weren’t enough to send consumers into a panic, it was revealed that the breach occurred nearly two months earlier; Equifax was only getting around to announcing it now.

To make matters worse, the website that Equifax set up so consumers could check to see if their accounts were sullied didn’t work and could be used easily in a phishing scheme.

On top of that, the Equifax site required users to surrender the last six digits of their Social Security numbers to use it, and required victims to surrender all their legal rights to sue. Then whoever was running the company Twitter account tweeted out the wrong URL, using the phishing URL instead.

A few days later it confessed to another, previously undisclosed breach in March.

Augmenting the bad news, it was revealed senior Equifax executives sold nearly $2 million in company stock in August, days after the brand discovered the data breach but weeks before the Sept. 7 public announcement.

By the time the CEO was replaced and the brand got around to a decent apology, (including a promise of a better website and free credit freezes) its credibility was gone and its trust bank was empty.

CONTACT: [email protected]