Five years ago World Vision, a Christian relief organization that serves nearly 100 million people in 100 different countries, realized that its media coverage wasn’t nearly as big as its humanitarian footprint.

“Other NGOs were significantly surpassing us in telling their stories during disasters,” says Steve Panton, executive director of media relations for World Vision U.S. “This wasn’t really news to us,” continues Panton, “because anecdotally we knew it.” But World Vision set out to confirm that belief and find out exactly why their disaster coverage in the U.S. was lacking.

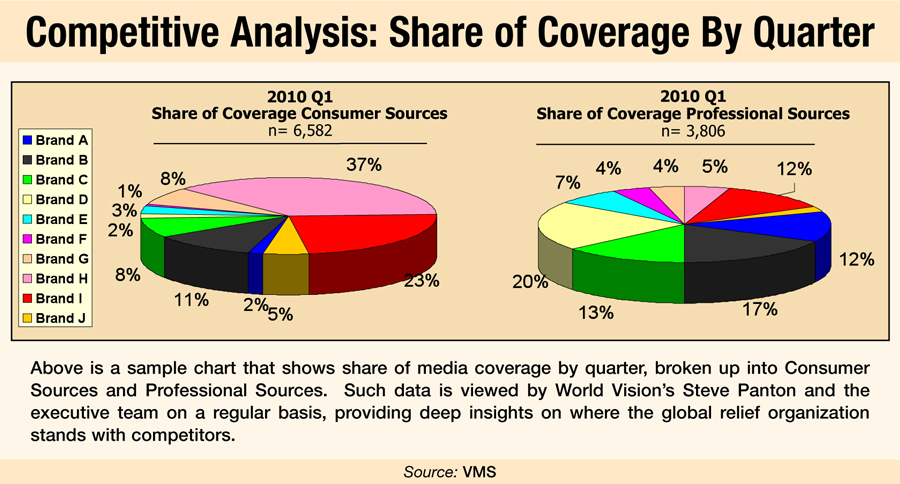

To do so, the organization hired media intelligence firm VMS to track the competition. VMS deploys its “share of discussion” methodology in tracking NGO competitors’ coverage vs. World Vision’s. This constant measurement, going on four and a half years, says Panton, has resulted in an increase from 17% share of voice to 55%.

Suffice it to say the result has Panton bullish on competitive analysis. “If you’re not using data to see what other folks are doing—if you just have data on yourself, it’s meaningless,” he says. “You can be happy with your organization’s performance, but if other folks are doing better, it’s not a good thing.”

PART OF THE PLAN

Competitive analysis isn’t just useful as a standalone measurement—it’s critical in making a PR plan, says Cari Brunelle, VP of public reputation services at Jaffe PR, which specializes in communications for law firms.

“Without competitive analysis, you don’t have benchmarks to compare to for your PR plan,” says Brunelle. “Without knowing how our clients stand against competitors, we can’t give them a strategy.”

ID THE COMPETITION

But just who are your competitors, and is it important to track each and every one of them? “If you have a list of 20 companies, there’s a temptation to treat them all equally,” says Jeff Altheide, senior VP of growth strategies and innovation at Gibbs & Soell PR. “It varies, but if you do a good job of tracking three or four of them, it can work out just as well as analyzing all of them.

Altheide recommends paring down competitors to track by looking at three key areas:

• The most direct competitor(s);

• Market share leader, or sales leaders;

• The most innovative organization in your space.

“If you want to be able to project the future in your industry, it’s key that you track the most innovative competitors,” says Altheide.

In terms of share of media, Brunelle identifies which law firm leaders have the most visibility and press mentions, and then seeks to find out why. Brunelle adds that particularly in the legal profession, firms sometimes miss key competitors because they often fly under the radar of the mainstream business press.

PRIMARY OR SECONDARY?

Research on competitors can run the gamut, from more expensive primary sources (brand new data conducted from competitor surveys, telephone interviews of your competitors’ customers and focus groups) to more cost effective secondary research (such as previous report findings, press articles and published data).

Altheide says his agency uses Harris Interactive for focus groups and Cision for media research on the primary end. He adds that they do employ less expensive methods to keep analysis costs down, relying on simpler yet just-as-effective methods. For one client, a professional association, Gibbs & Soell eschewed a more complex media analysis of competitors and informally surveyed key journalists instead. “Using that analysis, we were able to find gaps in coverage,” says Altheide.

Digital and social media audits of competitors are also done with low-cost or free tools—readily available to PR professionals, says Altheide.

GETTING GAME

According to World Vision’s Pantone, the magic is not in the competitive analysis itself. “It’s understanding what we’re seeing and acting on it that counts,” he says. In World Vision’s case, it was an immediate change in communications game plan and in media mix.

“We focused in on disasters—putting resources, staff and planning around them,” says Pantone. “We went from one person with a pager to everyone with a Blackberry to work on a 24/7 basis. This made a huge impact on our ability to tell our story during a disaster.”

Learning from competitors, Panton also put more resources into broadcast outreach. “Our media mix was skewed towards print, because it was much easier to tell story to multiple print outlets,” he says. “We’ve increased outreach to national broadcasters, including radio.”

Panton stresses that all of this process may seem self-evident, yet actually seeing competitive data reinforces the need for adjustments.

Most Gibbs & Soell clients are doing some basic tracking of competitors, says Altheide. Many are in the experimental phase, “Mostly to get a feel for the competition and justifying current strategies,” he adds.

The ultimate competitive analysis outcome? “Tracking over time, you can see how different campaigns are working against your competitors,” says Altheide. “Then you can start to get a real feel for the impact of your programs.”

CUSTOMER SPIN

PR and marketing firm Hellerman Baretz puts a spin competitive analysis—try “client and prospect analysis.” HB also works with law firms, and is taking advantage of the increasingly sophisticated business development and sales functions in the legal world

Spencer Baretz, partner and co-founder of HB, says that while his agency does analysis on competitors, the more valuable data it generates is on prospective clients for its clients. “Lawyers and practice groups are doing a wide variety of research to target, identify and close new business opportunities,” says Baretz. “We help them do that.”

EXECUTIVE IMPACT

The benefits of competitive analysis have become apparent to World Vision’s C-suite. “Our senior team and the board are able view our results versus our competitors’ results,” says Pantone. “These measurements are so ingrained that our president presents this data to the board, and that’s a significant shift.” PRN

CONTACT:

Steve Panton, [email protected]; Cari Brunelle, [email protected]; Jeff Altheide, [email protected]; Spencer Baretz, [email protected].