|

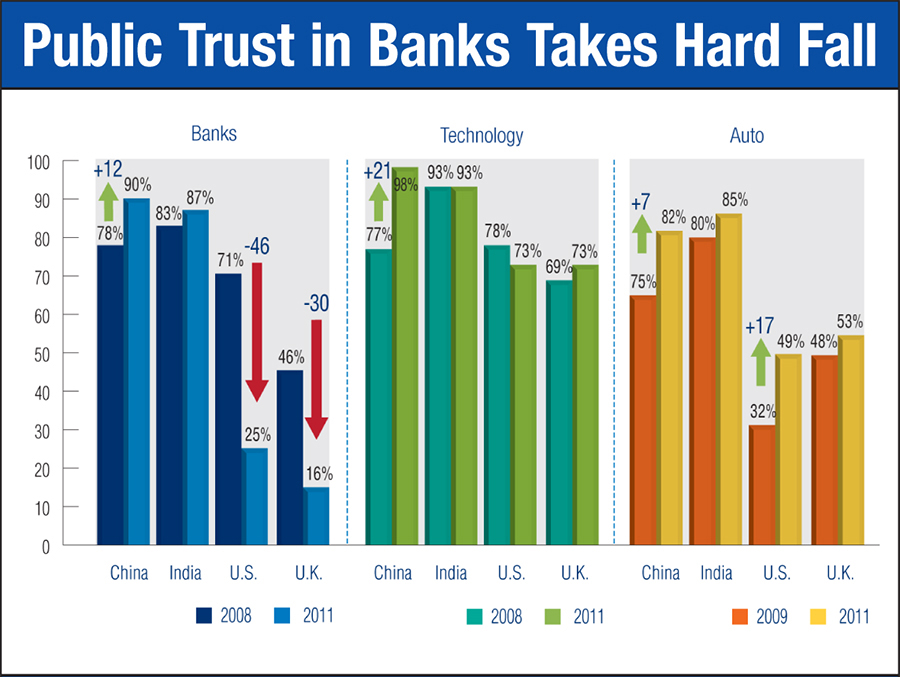

| While the technology and auto industries enjoy copious amounts of public trust, trust in the banking sector—in both the U.S. and the U.K.—dropped alarmingly, says the Edelman Trust Barometer report. Source: Edelman |

While trust in business was up or held steady in many parts of the world, in the United States trust was down, according to the 2011 Edelman Trust Barometer.

Trust in business saw a two-point global increase, surging in Brazil, rising in Germany and holding steady in China and India. In the U.S., trust in business fell by eight points to 46%—placing the world’s largest economic power within five points of last-place Russia—and decreased in government by six points to 40%, putting the U.S. among the bottom four countries with the least trust in government.

What dragged trust down in the U.S. is the banking industry. Financial services is the least trusted sector globally (50%), with banks as the second-least trusted (51%). In the U.S., trust in banks nosedived (see chart), with banks dropping from the No. 3 spot in 2008 (71%) to second from the bottom in 2011 (25%), tied with financial services.

“Skepticism has increased as a result of the systemic impact of corporate and government crises, causing a transformation in the framework of trust,” says Richard Edelman, president and CEO at Edelman. “Trust in business may have stabilized globally, but it is different and conditional, premised on what a company does and how it communicates.”

CUSTOMER FOCUS

From a communications standpoint then, what can be done to build trust of the banking industry? “Financial services plays a crucial role in our economy, employing thousands, lending to businesses large and small and helping people save and invest to buy a home, pay for higher education and fund their retirement,” says Bill Haynes, president of Boston-based BackBay Communications. “Unfortunately, the industry as a whole has not done a good job over the past few years in communicating this message.”

Haynes says for BackBay clients, PR around thought leadership of banking executives and testimonials from customers play a big role in building back trust. “PR needs to communicate consistently through multiple channels, including the media and on the Web,” says Haynes.

Scott Tangney, executive VP at Makovsky + Co., says communicating how a financial institution has helped its customers is indeed critical. “The key to earning trust will be the institutions that demonstrate they have actually changed and improved their customers’ well-being,” says Tangney.

Also key in regaining the public’s trust is the financial institutions regaining trust in each other, says Tangney. “Institutions must resume business at normal levels before there is a clear improvement in trust with consumer,” he says. “Industry and trade programs are a priority, and CEOs need to carry this message, as it is a top-down process.”

ANOTHER HURDLE

Financial institutions may have a long slog in regaining that confidence. Last week a congressional committee investigating the financial meltdown blasted top financial firms, saying the crisis was avoidable.

“This was the result of human action and inaction, not Mother Nature or computer models gone haywire,” the draft report reads. “The captains of finance and the public stewards of our financial system ignored warnings and failed to question, understand, and manage evolving risks within a system essential to the well-being of the American public.”

Communicators may have not brought on the financial crisis, but they can play a big role in dispelling the public’s mistrust.

CONTACT:

Bill Haynes, [email protected]; Richard Edelman, [email protected]; Scott Tangney, [email protected].